Over eighty years ago, the rise of synthetic polymers led to one of the most successful original products ever. This product used nothing that we would consider to be technology today. That's how long it’s been since there have been any material breakthroughs at scale.

Few people seem to question why we've not seen much progress in materials. It's easy today to think new materials are not that important. But as I've looked more into their history and potential startup opportunities, I increasingly think they will be.

This article is the first of a two part mini-series on a new and emerging materials paradigm. If someone had written similar articles, I would have simply shared that and not written them. But I did not come across anything satisfying enough. If you know of any, let me know!

Here in Part One, we’ll steelman the case for a new materials paradigm and why it matters. Part Two looks mostly at emerging materials, especially biomanufactured ones, and what they could enable.

I don't have all the answers here and I'm learning myself. For a long time, I did not really question why materials science and technology had or had not progressed. It just did not seem that interesting, and I had drunk the kool aid on the primacy of progress in the world of bits. But, what I have realized recently is that better performing materials will actually be a pretty big deal. As I have gone down this rabbit hole, I have become fired up about the opportunities I've uncovered by exploring ideas in this space. As has been true in previous energy transitions, new materials will become essential inputs to manufacture products in the coming decades.

I want this blog mini-series to clarify my thoughts and to also invite you to explore the possibilities of better, sustainable and high performance materials.

Contents

- How, the rise of synthetic polymers led to the commercialization of one of the most successful original products ever.

- How synthetic polymers were the most recent materials age and the problems that arose from this.

- Why progress in new materials has stagnated, including the limitations of fossil fuels as feedstocks.

- How companies like Allbirds and On Running had impressive traction (no pun intended) by using existing materials in new ways and using direct to consumer distribution.

- How products integrating software, hardware and other engineering might inform the future of products with next generation materials.

- Introduction to Part Two. How biomanufactured and other next-gen materials will create better, higher performance and eventually cheaper products.

An outsized product success

What comes to mind when you think of generation-defining first of a kind products? Maybe the original iPhone. I definitely would have thought the 2007 iPhone or perhaps a consumer electronics product.

Apple sold about 700,000 units of the original iPhone in the first weekend. Nintendo sold 300,000 units of the original Gameboy in the first two weeks. Tesla had 276,000 preorders for the Model 3 in the first three days. Candy Crush Saga had 4 million users within the first few weeks.

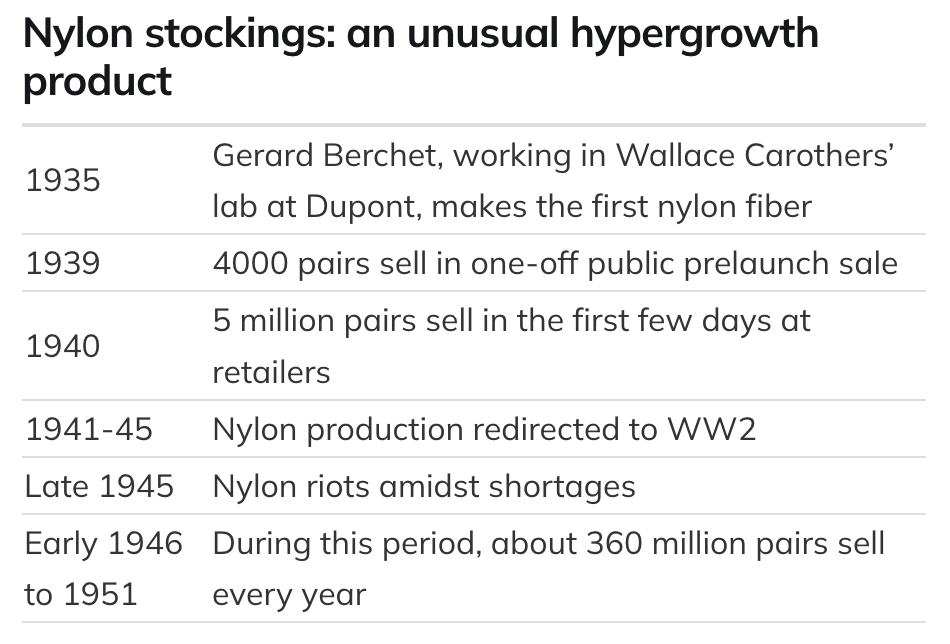

Yet this product I have in mind, developed and commercialized during the rise of synthetic polymers, held its own against any of those above. In the first few days, this product sold five million units; comparable to sales of the iPhone, Gameboy, the Model 3 preorders and number of early Candy Crush users... combined. It retailed for about $1.15 in 1940, or $24 in today's dollars. By the third full year of availability, 360 million units were flying off the shelves per year, good for over $6 billion in today's dollars. Original iPhone aside, I think only a handful of first of a kind products have had steep enough growth rates for revenue numbers like that in their third year. What makes the success of this product even more remarkable was that this happened before 1950.

That product was nylon stockings. It's probably one of the least well known product successes in history.

During the 1930s, silk was the incumbent material used in stockings. Silk was largely imported from Japan. Americans became less and less enthused about this as war tensions rose in the late 1930s, helping nylon's rise. Also, silk didn’t last very long and it tended to “run” once torn or ripped. Nylon in contrast, lasted longer, was strong enough to move a small car and didn’t run as easily. It had superior material properties for this market. Also, being synthetic with fairly price-stable inputs, it didn't face the same price volatility as silk supply even though it was more expensive than silk. Dupont saw the potential of their new material and executed fast.

Nylon stockings became available in retailers in 1940, a mere five years after being invented. Five million pairs flew off the shelves in the first few days. The following year, production was diverted for the war to make parachutes, ropes, mosquito netting and even flak jackets. After the war ended, Dupont again turned to producing nylon stockings in late 1945 but could not ramp supply fast enough. Nylon Riots happened in late 1945 as women fought over limited supplies. For example, On one day, 40,000 people in Pittsburgh waited in a line over a mile long just to have the chance to buy a pair.

Dupont's success with nylon stockings is perhaps shown in terms of how quickly a majority of women started wearing them. Nylon stockings sold for $1.15 a pair in 1940 or about $24 today adjusted for inflation. Sales in 1946 were over $400M after Dupont ramped production to 360 million pairs per year. Similar volumes were sold until the early 1950s. There were 42 million American women 21 and older in 1940 and on average women were buying 15 pairs of stockings per year. So in the late 1940s, there were enough sold for 24 million or 57% of US women to exclusively use nylon stockings.

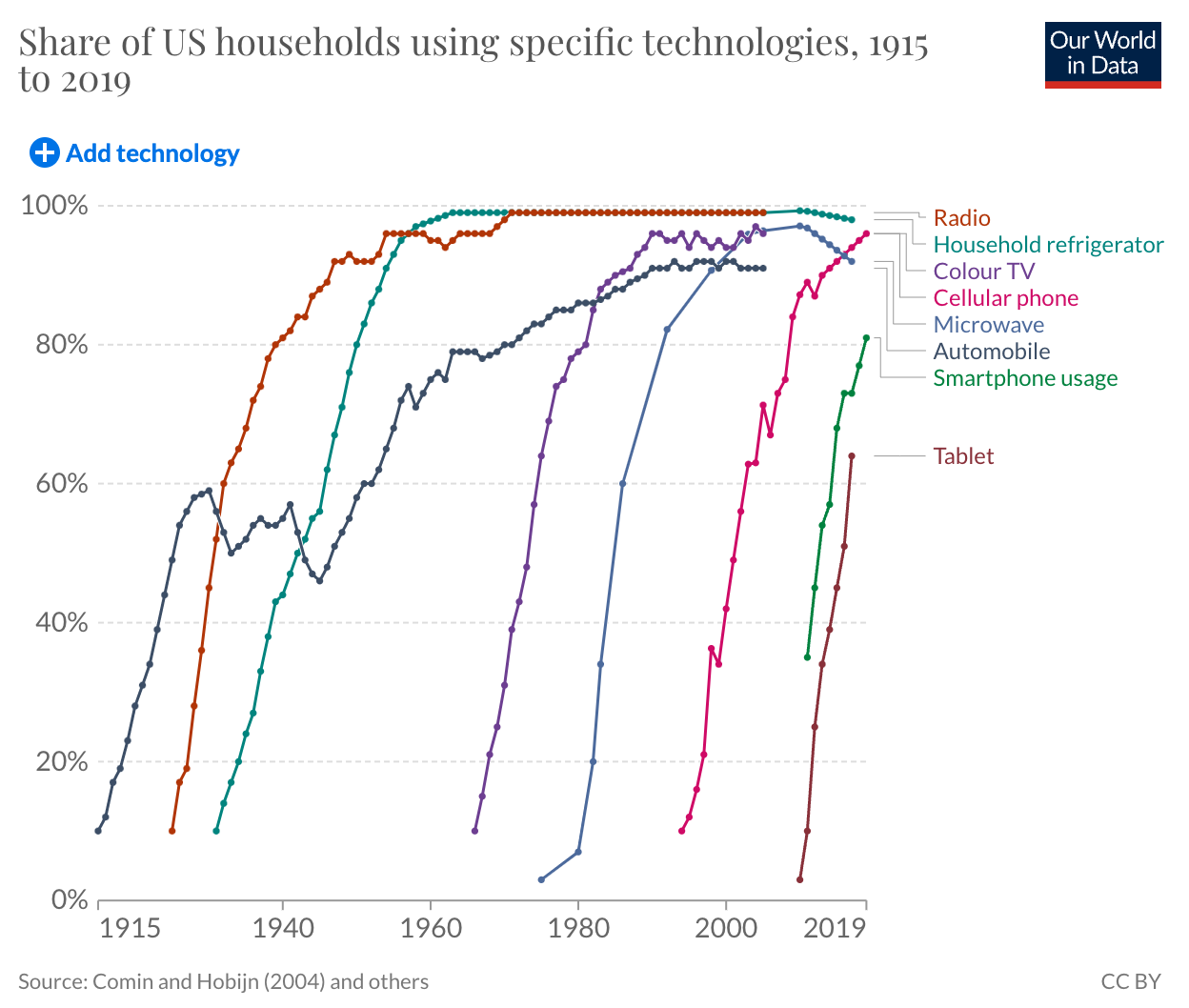

This pace means nylon stockings were adopted faster than all of the following products, even smartphones and tablets:

Nylon’s early success shows how much people could value a product made better with superior material properties. Outside of a few high value low volume industries that rely on advanced manufacturing today, startups largely no longer think of new materials as a key factor in building better products. We just have not had many new materials that have seen enough demand to come down the cost curve to produce at substantial volume.

Synthetic polymers: the most recent materials paradigm

During the early and mid 20th century, an increasing variety of synthetic polymers were invented and found many uses. It was a golden age of new materials with better performing properties.

Bakelite, the first synthetic polymer, was used in everything from radios to telephones and many other products from the 1910s thanks to its non-conductive properties and ease of production. At the peak of polymer discoveries during 1930s to 1950s, scientists at companies began to commercialize polymers like polyethylene, polypropylene, polyurethane, teflon, polyester and nylon as mentioned earlier. Low density polyethylene was a military secret used in Allied radar insulation during WW2 and later in kitchenware, toys, prosthetics and of course, packaging. Teflon, which was also used secretly as a coating for uranium parts in the Manhattan Project, before becoming synonymous with Tefal "non-stick" pans in the mid 1950s.

The early 20th century saw a veritable Cambrian Explosion of materials. Synthetic polymer production doubled every 2.5 years (at 31% CAGR) between 1911 and 1950 from 45 tons to 1.5 million tons. As their usage grew, costs came down and quality improved in a flywheel effect that opened up even larger markets. Note that since 1950, production has slowed down almost every decade. The 1950s saw a CAGR of 18.2%, whereas in the 2010s, it was 4.4% off a base that is two orders of magnitudes higher.

One way to capture the incredible success of plastics is to consider the speed and scale that production is at today alongside other foundational materials.

Today, the world produces more plastics per year than almost every other material. Only steel, iron and materials used for steel or concrete inputs exceed plastics production by mass. Plastics output is about 3x that of aluminum, which is the metal with the second highest production volume after steel. The value of the plastics industry is over half that of the global steel industry.

Perhaps the best indication of success is how invisible a technology becomes and the extent to which most people take it for granted.

We rarely stop and wonder at how steel and concrete came to be all around us. Or how the internet has enabled far more and higher bandwidth communication across time and space. The same is true of synthetic polymers.

If we didn’t have them today, think about all the products that would be more expensive, would be worse products or even would not economically exist. On average, 330 pounds (150 kg) or 8% of a car's weight is plastics for fuel efficiency and light-weighting. This share will rise with soaring EV adoption. Without them, most cars would be significantly heavier, more expensive to fuel up and run, and require more robust structural components, tires and suspension. Goods like appliances, many electronic devices and even shoes would need to use more expensive natural polymers. These natural alternatives are also resource intensive and prone to bad crop harvests. Before Bakelite, insulating resins were sourced from shellac from the lac beetle. Ivory from elephants were used for billiard balls and natural rubber from trees. To provide insulating materials for wires and power boards instead, we'd need natural alternatives at low costs that are likely unprofitable. Polyurethane-made memory foam mattresses would not exist, and we’d have to find an alternate source for furniture foam cushions. These examples are just the tip of the iceberg for the vast array of synthetic polymers used in practically every industry today.

In addition to better properties, plastics have become a part of so many products because of cost. They've become so inexpensive that commoditized plastics are synonymous with being cheap. However, cheap materials does not have to imply poor quality. The success of a new paradigm of materials would hinge upon the ability of many of those materials to become cheap, ie come down the cost curve, and to offer better properties than plastics and other materials today.

Problems arising from world-scale plastics use

Globally, we’re now using an estimated 438 million tons of plastic per year. Barring better alternatives, we're on track to quadruple that by 2050. Much of that tonnage ends up in waterways killing animals, accumulating in microplastics with unknown health risks or landfills where most do not degrade. End-of-life processing has become a serious problem. Plastics production uses about 8% of global oil demand, and helped continue the rise of fossil fuels in the mid to late 20th century.

In 2018, packaging generated 46% of global plastic waste but was only 36% of global production. This gap arises from a short-used lifespan of most plastics for packaging and almost no recyclability. This needs to improve, but it's hard to see much progress today where a mere 10% of all plastics produced since 1950 have estimated to have been recycled, let alone contribute to a more circular economy.

We can acknowledge the negative impact on climate and environment whilst also appreciating the progress and innovation that plastics has enabled. New, better and cheaper materials would resolve the glaring problems with plastics whilst unlocking even more benefits. We’ll talk more about that in Part Two of this series.

Along with steel, concrete, aluminum and silicon, plastics are foundational and essential materials for how we live today. But there’s one pressing question. If new materials are so important, why have we not seen new and better materials in the many decades since the rise of synthetic polymers?

Progress in materials has stagnated

Why? From my research, it seems largely from a lack of new raw inputs and technologies to process them. Yes, fossil fuel feedstocks have been vast and relatively cheap, disincentivizing most alternatives. Significant R&D in polymers, especially prior to the 1980s, helped commercialize the plethora of plastics used at scale today. But fossil fuels can only produce so many types of useful polymers economically. A wider diversity of feedstocks are needed.

As we learn to use new inputs, we become better at finding new material applications and integrating them into useful products. This has happened since our early ancestors chiseled stone into tools and spears, cut timber for shelter or fire, and weaved fibers for clothing.

Innovation in materials, like other technologies, follows an s-curve of adoption. We showed the s-curves above when comparing nylon stockings with other products, but it also applies when zoomed out to consider energy and materials technologies. The materials that scale to millions of tons of production tend to be coupled to the cheapest energy inputs available at their time. Coked coal heated steel furnaces, electricity powered aluminum smelting and oil and gas powered polymers. Like with new energy sources, new generations of materials have displaced uses of earlier ones and created completely new uses. As we discussed above, the novel properties of synthetic polymers at low enough cost allowed it to replace uses for timber, metal and other materials in some cases. These benefits also enabled them to create new applications that simply would not exist without them. Today, biomanufactured materials are so promising because they can potentially replace usage of plastics with molecularly identical alternatives and create entirely new applications not yet possible.

With plastics, the inflection point of the s-curve was early in the 20th century. This was when Bakelite and later nylon and other synthetic polymers quickly found uses because of novel and better properties. The problem was that the key inputs, fossil fuels eventually become constraints. They could only be wrangled and processed into a limited number of different molecules and hence materials. Despite all of the ways plastics are used today, this is still a key limitation.

High and/or volatile prices of oil and gas for material inputs and process heat may also limit the growth of the plastics industry. We’ve seen this play out in the oil shocks during the inflationary 1970s, and in a more limited way during the late 2000s. Unlike those periods, there’s good reason to believe the current high oil and gas prices will persist. To be fair, humanity has managed to scale oil and gas production for over 100 years, no simple feat.

However, demand is falling slowly today and will accelerate largely because of the rapid electrification of mobility. EVs have already lowered oil demand by 3% globally, with 2/3 wheelers having the most impact and cars only beginning to contribute. This sounds like it would put lower pressure on prices but will likely have the opposite effect. New supply in fossil infrastructure is very constrained as companies avoid investing in assets with multi-decade payoffs that rely on that shrinking demand instead boosting shareholder returns.

In addition, drillers have been bitten by several boom bust cycles in the last decade, and their fuel, chemical, steel and labor costs are rising. Gas shortages, especially in Europe, can’t be replaced with other energy sources overnight, especially for Germany’s industrial reliance on gas. These factors could keep gas prices elevated for years. It's more likely than not that high prices of fossil inputs for input and process heat for polymers are here to stay.

This puts polymers in a weaker competitive position against any new emerging materials. We’ve seen many false alarms for high prices of incumbents accelerating a shift to replacements and none more recent than cleantech 1.0’s excesses. Yet when the new technology has been ready, a glance at history shows many examples of transitions away from incumbent products accelerated by supply constraints and high costs. Coal’s rise in 17th century England, synthetic rubbers and a vital enzyme in cheesemaking are all examples where upstart technologies have benefitted from supply constraints.

By the 1980s, companies developing polymers saw growth slowing and they had begun cutting R&D. At that point, engineers and scientists had already picked most of the low hanging material fruits off of petrochemical tree of materials. As William Nugent, an organic chemist at Dupont for 25 years explained:

R&D wasn’t as sure a winner as it had been in the 1950s and 1960s.

During that golden age, “there were things you could do with cheap building blocks that were abundantly available to the industry...”. But in more recent decades, “... you can’t afford to go down and mine exploratory chemistry anymore.”

Since fossil fuels, we have had no new inputs to produce better materials at scale. There are some exceptions. Silicon has achieved widespread adoption as the material that practically all semiconductor chips and 95% of solar PVs are built on. Lithium ion battery packs seem like they’ll increasingly do double duty as structural materials in cars and in the future in eVTOL and eCTOL vehicles. They can simplify engineering, reduce weight and save on material costs. Performance composites and materials like carbon fiber have found mostly niche though very useful applications. However, these materials largely do not replace the need for the expanse of material properties that plastics offer for a plethora of products today.

For the first time since the age of synthetic polymers, there are now a rising number of new inputs to produce new materials at scale. Synthetic biology will likely be one of the most important enabling new technologies. It opens up the potential for a huge range of cost-effective processes for producing new materials that we simply could not have had access to with fossil fuels. I'll be talking more about these new materials in Part Two of this article series.

How have startups created value in industries where materials are essential to product value? As we'll see next in a couple of startup case studies, some have been able to harness better ways to use existing materials and using direct to consumer distribution that have only become possible in the last dozen years or so. These startups have been able to make high performance and high growth products even with the lack of innovation in materials.

Current paradigm: using existing materials in better ways

Unlike Dupont's nylon stockings, startups from the last decade or so have not enjoyed the benefit of being founded during an emerging new materials age. Instead, they've had to focus on other ways to differentiate themselves. In industries in which materials drive the value of a product, startups have focused on novel uses of existing materials and tapping newer distribution channels like going direct to consumers (DTC).

We'll now look at Allbirds and On Running, two examples of recently public companies applying materials science and technology to shoes. The product vision, execution and distribution that have made these startups standouts in new consumer products will be table stakes for the startups of tomorrow using new materials. Being a first mover to utilize novel materials would just amplify potential value creation. Because of that, I think new startups can learn a lot by looking at what made these two companies successful. Let's, er, step in to it.

Allbirds

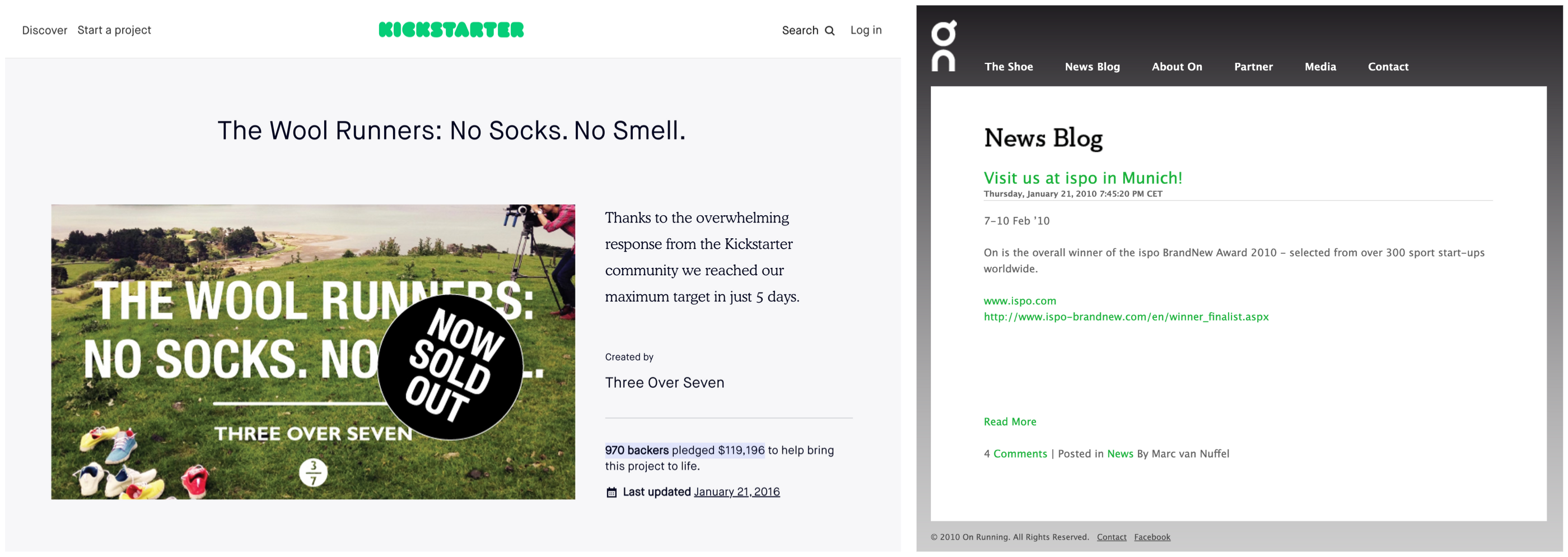

Tim Brown, the Kiwi founder of Allbirds, had wanted to make a more comfortable all day shoe for years. Years before starting the company, he had realized using an engineered merino wool fabric was a great start, improving the feel of the shoe’s upper. This also took advantage of merino’s naturally useful properties like wicking, odor resistance (no socks!) and a soft, plush feel. After scoring almost 1000 preorders in a 2014 Kickstarter, he reached out to Joey Zwillinger, his later cofounder and an industrial engineer. Joey had worked at Solazyme, a now-defunct synthetic biology startup, and has said just how important performance materials were to Allbird’s product development:

"There’s so little focus paid to innovating around natural and/or sustainable raw materials in a consumer landscape. There was a big opportunity for brand building and marketing sustainable, high performance products."Joey Zwillinger, Allbirds Cofounder and Co-CEO

But of course, Allbirds was only able to draw from the same set of materials that other shoe companies had access to before. Their key product insight was in redesigning an existing material (merino wool) to be suitable for shoe uppers, which was a world first.

On Running

In the late 2000s Olivier Bernhard, the Swiss brainchild of On Running, was searching for a better running shoe. An engineer had finally persuaded him to try a radical design: a sole made from cut garden hose tubes. Bernhard was skeptical but felt the surprisingly value of cushioning and bounce from running in these. On Running was born from this idea as a new way to cushion running shoes. They designed novel geometries using existing synthetic materials like EVA (ethylene vinyl acetate) in their soles.

They're continuing to experiment with combining existing materials, and even castor bean-derived bioplastic in pursuit of a better running experience. It's likely that younger companies like On will be far faster than incumbents to adopt the high performance materials of the new paradigm.

Direct to consumer

DTC have helped both Allbirds and On and many other startups in the last decade go to market and scale. DTC distribution has exploded because of the internet, enabling startups with strong product differentiation to do several things they couldn’t before. DTC made discoverability and organic growth far easier and faster. It also lowered the cost, time and complexity to having a storefront. Finally, DTC gave startups control over crafting their story, product perception and brand in a way that was never possible before. The key is that the product has to be better. Then, DTC and brand and marketing overall can be more effective.

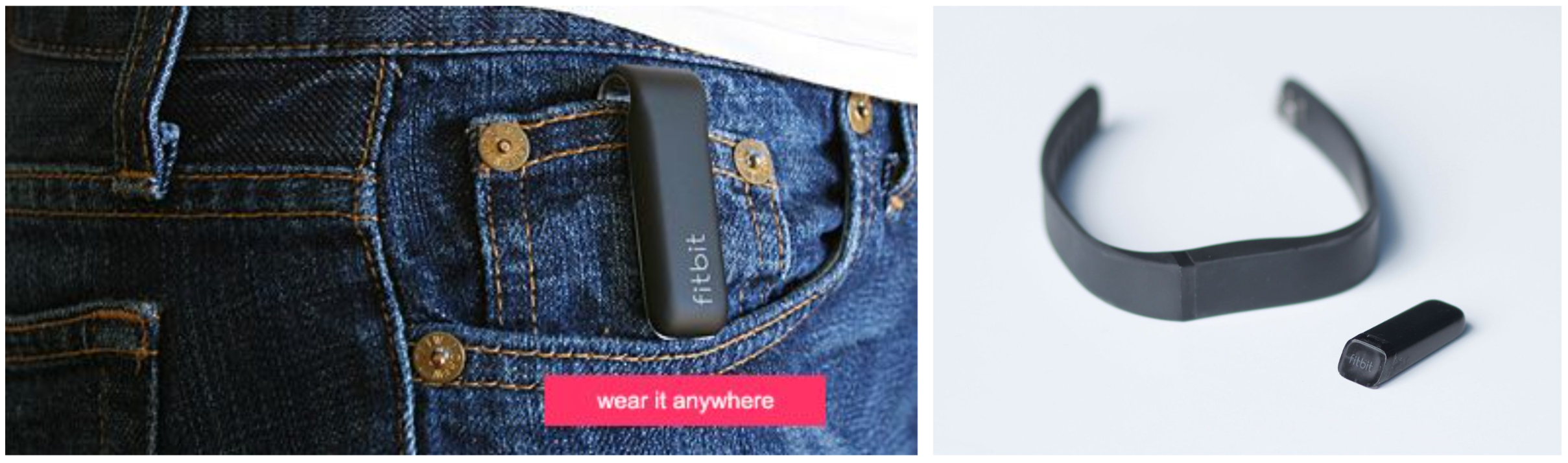

Richard Branson's Virgin Records and later also Netflix (their DVD offering of course) initially used mail order distribution to seed their companies. More recently, computers in every pocket and on every desk has enabled DTC to be a huge competitive advantage against a variety of incumbents. Startups making products from shoes (Allbirds) to wearables (Fitbit) to cars (Tesla) have had DTC-first distribution strategies.

Allbirds used DTC online superbly to demonstrate product market fit and scale. The early kickstarter campaign had to be stopped after only 5 days. It showed over one thousand people were willing to buy the product. They launched in early 2016 and it was an instant hit with millennials and SF techies. Demand exploded, with their initial 15000 shoe inventory sold out fast and $1M of sales in the first month. I first heard about Allbirds after moving to SF in late 2017, where many of my then tech colleagues at Uber would rave about them. Their product differentiation unlocked strong word of mouth organic growth, avoiding sinking too much into online paid ads and keeping customer acquisition costs low. They also later set up their own brick and mortar stores. One product concern has been the durability of the shoe's upper and the outsole, which is indicative of the performance/sustainability tradeoff in many products today.

On Running didn’t find as much traction early on with online DTC. I think this comes down to two factors. It was founded earlier and runners in Europe in particular perhaps were less used to buying shoes online at the time. They scored their first two thousand orders at a conference in Munich during their first year operating in 2010. Despite having their online store live in 2011 shipping product to Europe and US/Canada, they leaned more on retail distributors early on. Hesitant retailers became convinced when they tried running with the shoes. Later, they invested in their online store and recently established a flagship store in Manhattan. DTC share of sales have grown to 37% in 2021 and is now On's fastest growing channel. Without DTC, their retail growth would have been limited post COVID and their 2021 IPO would not have been as compelling. On also has netted a small profit as of Q1 2022.

Strong growth despite being constrained by the current materials paradigm

The growth of Allbirds and On Running have both been exceptional. In 2021, Allbirds had grown in seven short years (counting from the cofounder's 2014 Kickstarter) to $277M in revenues and On in eleven years had climbed to $724M. Allbirds is not yet profitable, though On has been marginally profitable for a quarter. However, some of the largest public SaaS companies like Atlassian, Twilio and Hubspot amongst others are still not profitable either despite all being more than 12 years old. This is not dunking on them or SaaS startups in general, these are all companies with valuable category-leading products. What this comparison shows is just how well Allbirds and On Running have done whilst being constrained by the materials available today.

Because they could not innovate on the material level, the product and distribution had to be better for these companies to have had this success in recent years. How much faster would they have grown if they had been started during a time when novel materials were emerging? How much better would their products have been and how much more value would customers have gained from using their products?

The role of hardware, software and other technologies

As I said up front, I have been exploring these ideas and don't have all the answers. Perhaps this point most applies to how novel materials will integrate with hardware, software, AI and/or batteries in future compelling products. Unlike materials, these have been more important and more familiar technological drivers of innovation in recent decades.

I do think a new materials paradigm will be an enabler and complementary to these technologies. As discussed above, polymers with better properties enabled us to make products that were just not possible previously. The same happened with steel unlocking skyscrapers and stronger car body parts, aluminum enabling lighter engines and planes, and finally Gorilla Glass being the capacitive touch interface on over half of all smartphones today.

But I am less sure about the shape of new materials x other tech. Of course, novel material properties are vital to what this might look like. We'll talk about some of the properties of emerging new materials in Part Two of this blog series. I'll also talk more about automation and AI then.

For now, I want to touch briefly on Tesla and Fitbit as case studies. These two companies have been world-class at integrating hardware, software and batteries into standout consumer products. This might give some hints at the future of the interplay between these technologies and new materials.

Tesla

Perhaps no company has been more of a hardware, software and batteries integration pioneer than Tesla. For their first model, the OG Roadster, gluing together thousands of cylindrical battery cells from laptop batteries was good enough. This allowed them to pioneer the integration of electric propulsion into a vehicle form factor. Tesla pushed the boundaries, reengineering a car around the integration of battery pack, motor and power electronics.

You can see in this video @1:15, in which Tesla's VP of Vehicle Engineering, Peter Rawlinson, discusses the original Model S's motor, gearbox and power electronics all integrated in the rear suspension system. It was recorded in 2011 before the Model S launch the next year.

This world-leading powertrain engineering was coupled with DTC distribution since their beginning. Their DTC sales has been exclusively online-only since 2019. A DTC strategy was a risk in the late 2000s but has driven incredible success with preorders, especially for the Model 3 and Y. DTC has lowered Tesla’s customer acquisition costs by $2000 per car vs legacy automakers like Ford.

Materials science and engineering is quite important for Tesla. In late 2015, Elon poached ex Apple product design director Charles Kuehmann to work on both Tesla and SpaceX new alloy materials and aluminum in particular. Kuehmann's team helped develop new aluminum alloys for casting larger body parts in Teslas and stainless steel alloys for the Cybertruck and SpaceX's Starship. Last year, Tesla started a new materials application team tasked with accelerating the adoption of new materials and processes. I think startups will increasingly see more integration between engineering teams working on materials and other disciplines and product parts.

Fitbit

Fitbit was was both a tremendous success in its own right, and also a cautionary tale. It was the first hardware company to successfully integrate sensors into something you could wear, most notably an accelerometer for step counting.

In 2008 the founders James Park and Eric Friedman wanted a portable device that could help gamify exercise the way his Nintendo Wii had. They started Fitibit, despite not having any background in hardware nor experience with supply chains. They raised a $400K seed round in 2008, which was only enough to make a prototype of their circuit board in a wooden box. With that, they pitched their Fit tracker at TechCrunch Disrupt that year, aiming for 20 preorders for their then-unbuilt device. Like with On Running in Munich, conference attendees loved the product and they scored 2000 preorders in one day. Before Christmas 2009, they had racked up 25,000 preorders of $99 each. They knew they were on to something. Being clips, men wore them clipped to their pant pockets and many women preferred to strap them to their bras. After the Fit, they shipped three more clip style wearables before their first wristband released in 2013.

Their sales tripled on average every year from 2009 through 2014 as their clip form-factor devices were clearly a hit with health-conscious tech-savvy customers. Fitbit went public in 2015 seemingly brimming with potential. Then the Apple Watch launched in April 2015 and just blitzed the market, blowing a $800 million hole in Fitbit’s band sales. Fitbit’s sales fell nearly every year from 2015 until their acquisition by Google for $2.1B. This made the founders and many early employees very rich, but it was half of their valuation at IPO.

Fitbit was the first hardware company to successfully integrate sensors into something you could wear. But unlike Tesla’s EVs, their products were adjacent to incumbents' core products, in this case Apple. I don't have inside information on Fitbit's product roadmap nor execution at the time, and hindsight is 20/20. But it did seem like they could have been faster to launch both their first wristband (two years later than Jawbone) and their first smartwatch (lacking the features and design of Apple's Smartwatch). In some ways, Fitbit ended up like Nokia. Both built category-defining products but missed the boat on new product insights that led to being crushing by Apple.

The leading performance product startups of the 2020s will likely integrate software and hardware as well as Tesla or Fitbit did. They will probably leverage automation and AI too. I think they will utilize some of the emerging materials, biomanufactured materials in particular, and include highly cross-disciplinary teams of engineers to build amazing things.

Towards a new materials paradigm

Materials matter. I increasingly believe new and better materials redefine what is possible for startups to build, industries to use, and societies to imagine.

As we’ll see in the second part of this series, we are starting to see a transition to biomanufactured and other promising materials that are better performing and default-sustainable. As a quick preview, we'll cover materials like spider silk protein fibers (super strong, tough, flexible and lightweight) and algal oil based urethane (tensile strength and vibration damping), as well as self healing biomaterials and materials like graphene (12 thousand tons produced last year, growing at 62% CAGR over three years).

For the first time in several generations, we may be on the cusp of another material paradigm that changes everything. This would be a multiplier for the accelerating energy transition from fossils to clean electrons. It would also unlock another dimension in tomorrow's products that startups today have not had access to.

This decade will be an incredible time to build.

This was interesting, thanks. Totally agree that plastic is underrated, and that materials in general are underappreciated.

I would love to hear more of the history of how plastic was developed, and to understand better what all the different types of plastic are and how they relate to each other.

Synbio is a likely source of new materials; also nanotech?

I do see synbio as the most promising source of new materials with a huge range of properties, scalable manufacturing, and ability to come down cost curves amongst other tailwinds. Graphene, as an example of perhaps a nanotech material, is also scaling well in an array of uses after surviving a hype cycle. Metamaterials are talked about a lot, but seems like we're still earlier in their commercialization from my limited understanding of them.

On the history of the development of plastics, this is thorough and one of the better resources I've found. It's a 20 part series of articles (and counting since last I checked). I've linked all of them here as the url path naming convention is inconsistent.

Tracing the History of Polymeric Materials: Part 1

Tracing the History of Polymeric Materials--Part 2

Tracing the History of Polymeric Materials, Part 3

Tracing the History of Polymeric Materials, Part 4

Tracing the History of Polymeric Materials: Part 5

Tracing the History of Polymeric Materials: Part 6

Tracing the History of Polymeric Materials: Part 7

Tracing the History of Polymeric Materials: Part 8

Tracing the History of Polymeric Materials: Part 9

Tracing the History of Polymeric Materials: Part 10

Tracing the History of Polymeric Materials: Part 11

Tracing the History of Polymeric Materials: Part 12

Tracing the History of Polymeric Materials, Part 13

Tracing the History of Polymeric Materials: Part 14

Tracing the History of Polymeric Materials: Part 15

Tracing the History of Polymeric Materials: Part 16

Tracing the History of Polymeric Materials: Part 17

Tracing the History of Polymeric Materials: Part 18

Tracing the History of Polymeric Materials: Part 19

Tracing the History of Polymeric Materials: Part 20

Another future potential to consider is atomically precise manufacturing—true “nanotech”, rather than simply nanomaterials—which could allow some really incredible possibilities such as manufacturing or construction with diamond. See Where Is My Flying Car?

That blog series looks great, thank you!

Sure thing, thanks for the link!

True atomic scale manufacturing is definitely an exciting future tech! One angle from some proponents of cell-free catalysis is that enzymes is a path to atomic scale manufacturing and assembly. For example, Aether Bio has nano-manufacturing in the spirit of what you are saying as their vision.