Imagine you could go back in time to the ancient world to jump-start the Industrial Revolution. You carry with you plans for a steam engine, and you present them to the emperor, explaining how the machine could be used to drain water out of mines, pump bellows for blast furnaces, turn grindstones and lumber saws, etc.

But to your dismay, the emperor responds: “Your mechanism is no gift to us. It is tremendously complicated; it would take my best master craftsmen years to assemble. It is made of iron, which could be better used for weapons and armor. And even if we built these engines, they would consume enormous amounts of fuel, which we need for smelting, cooking, and heating. All for what? Merely to save labor. Our empire has plenty of labor; I personally own many slaves. Why waste precious iron and fuel in order to lighten the load of a slave? You are a fool!”

We can think of innovation as a kind of product. In the market for innovation there is supply and demand. To explain the Industrial Revolution, economic historians like Joel Mokyr emphasize supply factors: factors that create innovation, such as scientific knowledge and educated craftsmen. But where does demand for innovation come from? What if demand for innovation is low? And how much can demand factors explain industrialization?

Riffing on an old anti-war slogan, we can ask: What if they gave an Industrial Revolution and nobody came?

Robert Allen thinks demand factors have been underrated. He makes his case in The British Industrial Revolution in Global Perspective, in which he argues that many major inventions were adopted when and where the prices of various factors made it profitable and a good investment to adopt them, and not before. In particular, he emphasizes high wages, the price of energy, and (to a lesser extent) the cost of capital. When and where labor is expensive, and energy and capital are cheap, then it is a good investment to build machines that consume energy in order to automate labor, and further, it is a good investment to do the R&D needed to invent such machines. But not otherwise.

And, when he’s feeling bold, Allen might push the hypothesis further: to the extent that demand factors explain the adoption of technology, we don’t need other hypotheses, including those about supply factors. We don’t need to suppose that certain cultures are more inventive than others or more receptive to innovation; we don’t need to posit that some societies exhibit bourgeois virtues or possess a culture of growth.

Let’s examine Allen’s argument and see what we can learn from it. First I’ll summarize the core of his argument, then I’ll discuss some responses and criticism and give my own thoughts.

High wages and cheap energy

In the first half of the book, Allen establishes that pre-industrial Britain was indeed a high-wage, cheap-energy economy.

Wages

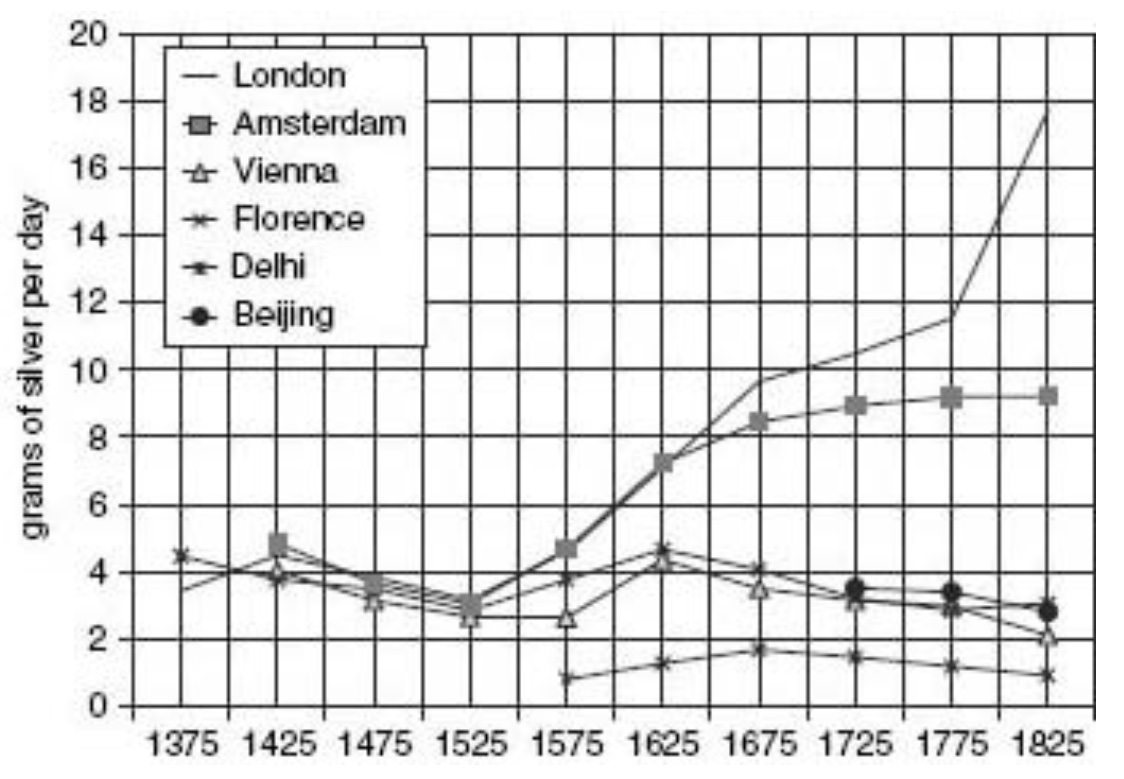

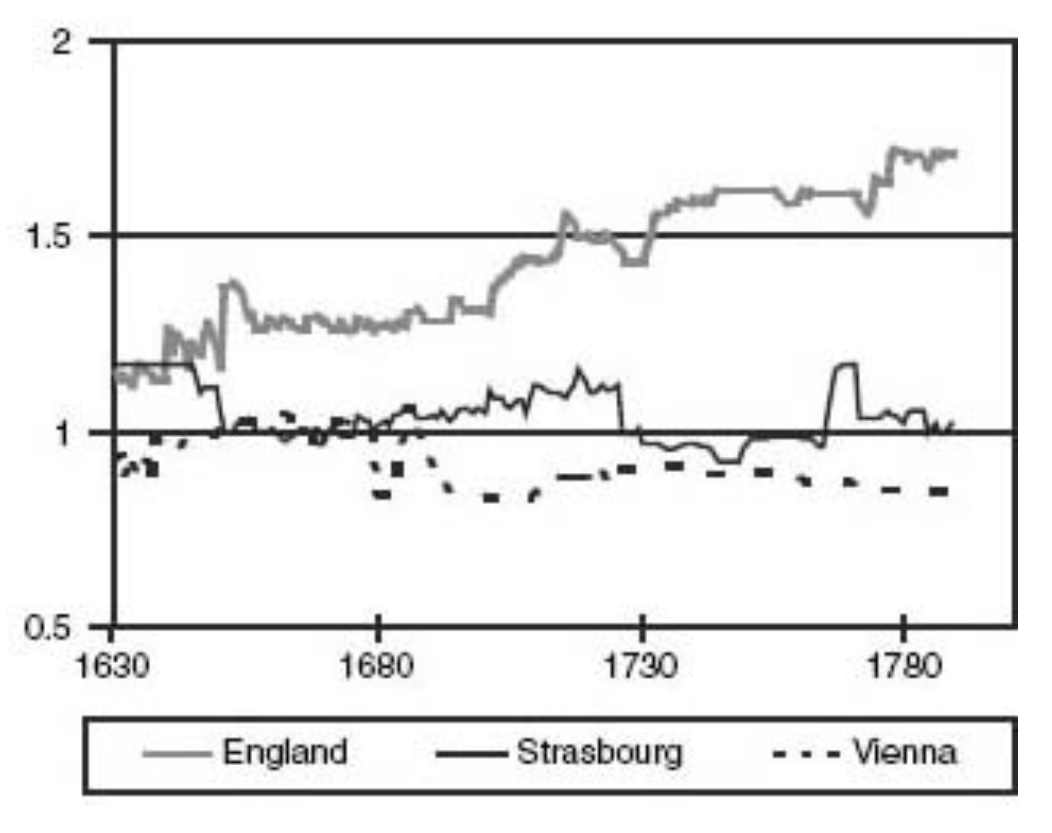

Here are workers’ wages in various cities around the world. By the 18th century, wages in London and Amsterdam were more than twice that of other major cities:

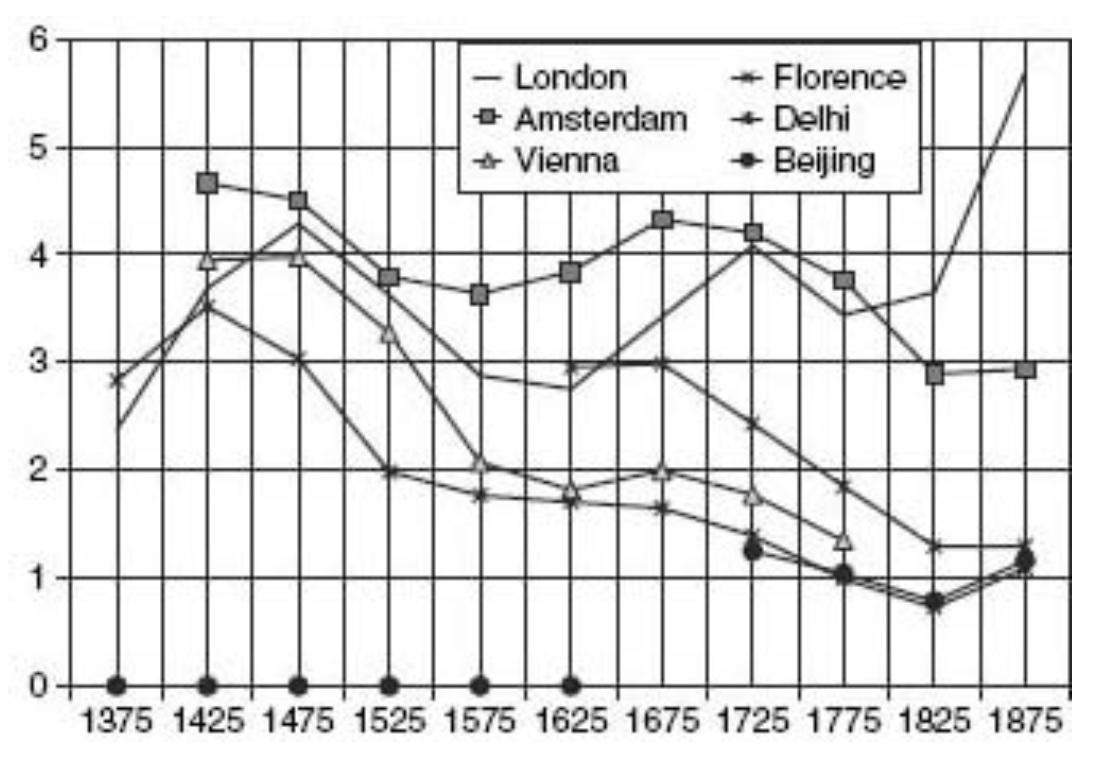

Nor is it just that prices were higher in those cities. Here are the wages deflated by the cost of a “subsistence basket,” the bare minimum of food, clothing, and other goods needed to live. Workers in Vienna, Delhi, or Beijing were only a little above subsistence; those in Amsterdam or London were ~4x above:

There is also qualitative evidence of high wages. Workers in Northwest Europe ate better diets, “in view of the apparent widespread consumption of expensive and highly refined foods like white bread, meat, dairy products and beer. In contrast, workers and peasants in France, Italy, India and China ate a quasi-vegetarian diet of grain, often boiled, with scarcely any animal protein. Diets like these were consumed only by the poorest people in Britain or the Low Countries.” And 18th-century Englishmen bought more consumer goods, including “tropical foodstuffs (tea, sugar, coffee and chocolate), imported Asian manufactures (cotton textiles, silk and Chinese porcelain) and British manufactures (imitations of the Asian imports and a wide range of other items like clothing, books, furniture, clocks, glassware, crockery and metal products).”

Energy

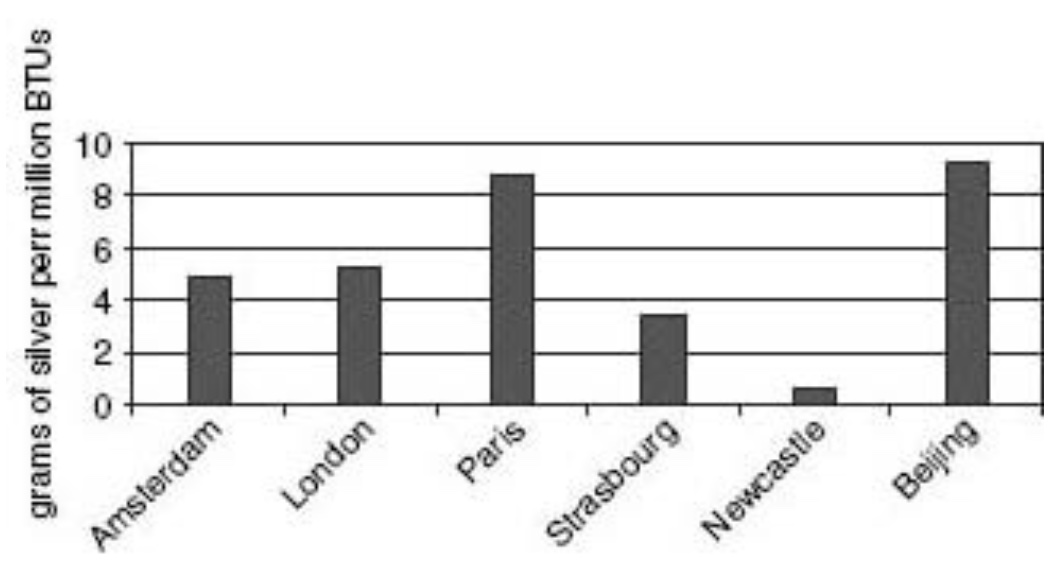

Here are some comparative energy prices:

Note that prices were moderate in London and Amsterdam, but they were extraordinarily low in Newcastle, near the coal mines themselves.

I found Allen’s analysis of energy as a factor in industrialization to be the most persuasive that I have read. Merely gesturing at Britain’s coal deposits isn’t good enough, because steam engines can be run on any fuel that produces fire, including wood and peat. Henry Ford, in his youth, is said to have run a portable steam engine to do farm work, and to have fueled it with old fence posts and corn husks. But Allen looks at multiple types of fuel, and compares not just availability but costs.

Relative costs

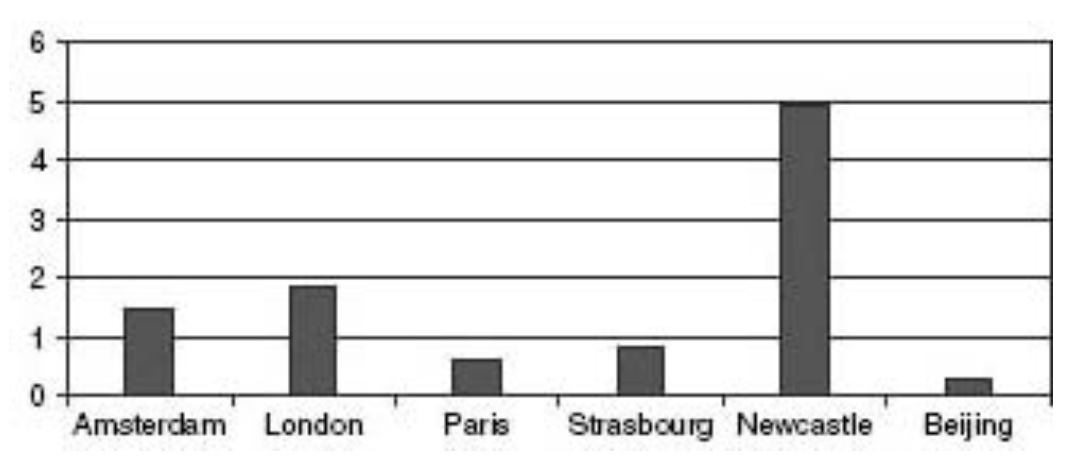

Combining these factors, here is the ratio of labor to energy costs in different places:

And here is a comparison of wages vs. the cost of capital:

In short: England, and especially the coal-producing counties, had more economic incentive to mechanize than anywhere else in the world.

Case studies: steam, textiles, iron

In the second half of the book, Allen takes three central stories of the Industrial Revolution as case studies, and argues that demand factors explain the timing of their adoption.

The steam engine

The Newcomen steam engine was terribly inefficient with fuel, so it could only be run profitably if fuel was very cheap, and if the work done by the engine was very valuable. This is why the first applications of Newcomen engines were at coal mines themselves, where there were no fuel transportation costs. In fact, you could feed the engine scraps of coal from the mine that were not suitable for sale, making the fuel virtually free. The other reason that these engines were mostly used at mines was that they generated a reciprocal motion, which was good for pumping, but which didn’t translate easily into the rotary motion needed in many industrial applications. (In fact, in some of the earliest applications of steam power to factories, the engine was used to pump water upstream, which then drove a water mill (!): these instances “are usually thought of as steam engines supplementing inadequate water power, but they can also be analyzed as a technique to improve a Newcomen engine by adding to it a water system so that the engine produces smooth, rotary power.”)

Because of these factors, the distribution of Newcomen engines closely follows the distribution of coal fields. “Since most of the coal mines were in Britain, so were most of the engines… Belgium, with the largest coal-mining industry on the continent, was second,” followed by France. “The diffusion pattern of the Newcomen engine was determined by the location of coal mines, and Britain’s lead reflected the size of her coal industry—not superior rationality.” Further: “Non-adoption was not due to ignorance: the Newcomen engine was well known as the wonder technology of its day. It was not difficult to acquire components, nor was it difficult to lure English mechanics abroad to install them. Despite that, it was little used.”

With iterative improvement, steam engines became much more fuel-efficient: early Newcomen engines consumed ~45 pounds of coal per horsepower-hour; the most efficient engines of the late 1800s used less than one pound. And the engines became better adapted to rotary motion. Allen says that this explains the diffusion of steam power to more industries:

… water and wind remained the dominant sources of power until about 1830. It was only between 1830 and 1870 that steam became pre-eminent…. The decisive shift to steam occurred in the middle decades of the nineteenth century after high-pressure compound engines cut costs…. The effect of cheaper power on its spread can be seen in the diffusion of famous technical processes. Van Tunzelmann (1978, pp. 193, 200), for instance, has shown that the power loom and the spinning of high-count yarn with the self-acting mule became cost-effective as power costs dropped in the middle of the nineteenth century.

This is a general pattern: the first version of a technology is relatively expensive and inefficient, and so it only gets used in one location or for one application where demand is intense. As the technology is iteratively improved, and its cost-benefit ratio decreases, it diffuses to other locations and uses with more moderate demand.

As another example, economics can explain the shift from sail to steam ships:

By 1855, the trade between Britain and ports in France and the Low Countries was steam, and by 1865 steam had displaced sail on cargo voyages to the eastern Mediterranean, a journey of 3,000 miles. By the early 1870s, steam was established on trans-Atlantic routes of 3,000 miles, and the 5,000-mile voyage between Britain and New Orleans shifted to steam in the late 1870s. By the 1880s, steam displaced sail on trade between Britain and Asia. These transitions occurred when the cost of shipping freight by steam dropped below the cost by sail.

And it explains diffusion patterns outside Britain:

… there was very little steam capacity in France or Germany around 1800. Indeed, it was not until the second third of the nineteenth century that steam capacity expanded sharply, and steam came to play an important role as a power source for industry. The rapid take-up of steam for manufacturing outside of Britain followed immediately upon the use of compounding in rotary steam engines, a change which sharply cut the cost of power.

Cotton manufacturing

The first machines to automate cotton production were not powered by steam, so here energy prices are less relevant. Instead, the relevant factor is the relative cost of capital and labor:

The cotton mill of 1836 was so efficient that it could out-compete hand spinning anywhere in the world. By the middle of the nineteenth century, cotton spinning mills were being built even in very low wage economies like India. It was not always like that, however. In the middle of the eighteenth century when machine spinning was in its infancy, it was only profitable where labour was very dear.

For instance, a spinning jenny with 24 spindles cost 70 times as much as a spinning wheel. They were taken up rapidly in England, but not in India, and not even in France, despite the French government actively promoting them. “Was this bad entrepreneurship or cultural backwardness?” No. Allen calculates the ROI of a jenny and finds:

… the rate of return to buying a jenny was 38 per cent in England, 2.5 per cent in France and –5.2 per cent in India where it was a dead loss…. These differences were due to the differences in wages relative to capital prices. Britain’s high wage economy meant that a 24-spindle jenny cost 134 days of earnings in Britain compared to 311 days earnings in France and even more in India. On the figures, it is no wonder that putting-out merchants found the jenny irresistible in England but unattractive in France or India!

A similar analysis applies to Arkwright’s water frame and textile mills. Allen computes the rate of return from an Arkwright-style mill:

In Britain, the profit rate was 40 per cent per year, while in France it was only 9 per cent. The English profit rate was excellent. The French return, on the other hand, was unsatisfactory since fixed capital invested in business could earn 15 per cent.

Allen concludes:

Profitability considerations are sufficient to explain why the spinning jenny and the water frame were invented in England rather than France or, indeed, most other parts of the world.

France adopted textile machinery once it became profitable, in early 1800s. The cost of labor had not risen, nor had the cost of the machines fallen, but the productivity of the machines had increased, which increased their ROI:

… the rate of return shot up to 34 per cent. This was very satisfactory, and the rise explains the shift to machine production in France and Belgium after 1815.

The US, which had high wages, adopted mechanization even earlier, in the late 1700s.

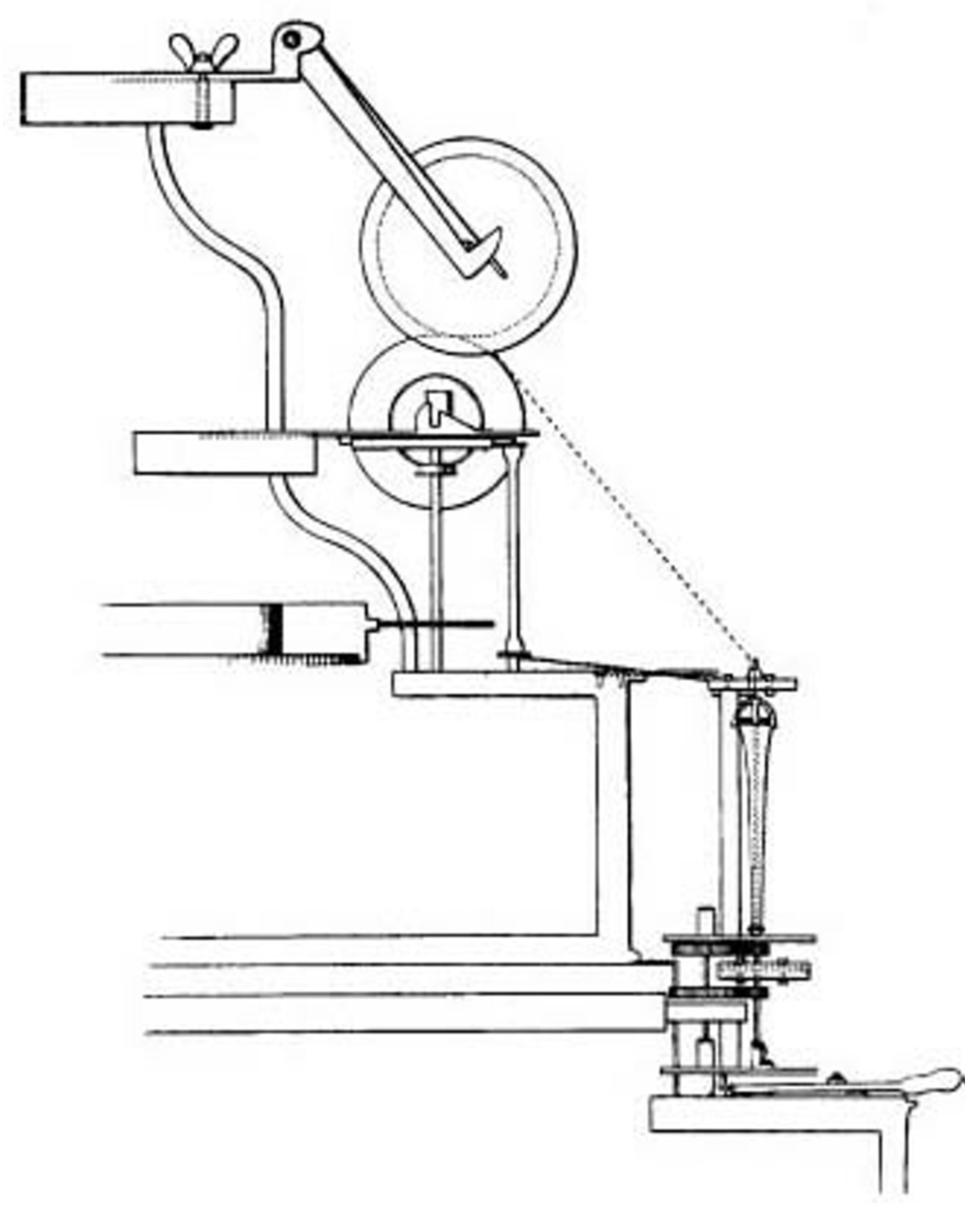

Incidentally, although it isn’t central to (and IMO actually runs somewhat counter to) Allen’s main argument, I have to highlight this fascinating bit about how textile mechanization depended on precision gearing from the watch industry:

The importance of watch-making for the textile industry cannot be overstated. The watch industry was the source of gears—brass gears in particular—and they were the precision parts in the water frame. Power was delivered to the rollers through gears, and gears controlled their speeds. Wyatt and Paul’s patent specification showed gears at the base of the flyer (Plate 8.6). When Arkwright began developing the water frame, he hired John Kay, a clock-maker, and later negotiated with Peter Atherton, a Warrington machine-maker, who supplied him with a smith and a watch-tool-maker. Without watch-makers, the water frame could not have been designed.…

Inexpensive gears revolutionized the design of machinery. Gears replaced levers and belts (as in the spinning wheel) to control, direct and transmit power. Mills had used gears in this way in the middle ages, but these gears were large, crude and made of wood. The gears of the Industrial Revolution were small, refined and made of brass or iron. ‘Clock work’ was used quite generally to control power in machinery in the nineteenth century, so gearing was the General Purpose Technology that effected the mechanization of industry.…

When Arkwright built his mills at Cromford, he hired clock-makers. One of his advertisements in the Derby Mercury in 1771 read: ‘Wanted immediately, two Journeymen Clock-Makers, or others that understands Tooth and Pinion well.’

Smelting iron with coke

Before the 1700s, iron was generally smelted using charcoal as fuel. Coal was not suitable as a smelting fuel because it contains impurities such as sulfur that weakened the iron. Before it can be used for smelting, then, coal has to be purified, basically turned into almost pure carbon. The resulting product is called coke.

Using coke for iron smelting was pioneered in Britain by Abraham Darby in the early 1700s, and was almost universal in that country by 1800, but other countries didn’t even begin to convert to coke until the mid-1800s. Again, this wasn’t because of cultural backwardness or resistance to innovation. Rather, it becomes profitable to switch to coke when you run out of wood for charcoal, and Britain ran out of wood first.

France makes the best comparison with Britain, because both countries had large and rapidly expanding iron industries in the 1700s. But coal was three-quarters more expensive in France than in England, whereas charcoal was less than half the price. So England smelted with coke, while France continued to use charcoal.

We can be fairly confident that factor prices were the cause of this difference, rather than lack of knowledge or interest, because (as with the jenny) the French government actively promoted coke smelting. In fact, a coke-burning iron works was built in the 1780s at Le Creusot, with the state as a major shareholder. Le Creusot had excellent technical advisers: the Wilkinson brothers, who had built coke furnaces in Staffordshire, and who came over from England to assist. The technology was state-of-the-art. It was set up for success in every way. But it was not able to produce cheap iron, and coke smelting was abandoned for decades. Then, in the 1830s, when charcoal prices were higher, and when the efficiency of furnaces had been improved, the works were acquired by new owners, who finally succeeded.

I consider this type of example to be very strong evidence for a statement of the form “X didn’t happen earlier because of Y”: an actual attempt at X that should have succeeded but failed because of Y, followed by a successful attempt later when circumstances changed.

Allen concludes:

Failure to jump on the technological bandwagon raises questions about the competence of the managers and engineers (Landes 1969, p. 216). Their performance can be assessed through a detailed analysis of business behaviour, and Fremdling (2000) has made a convincing case that the French were shrewd judges of technology. They did, indeed, adopt English methods on a selective basis that reflected profitability.…

It was not the impracticality of French engineering culture that explains the lack of attention to coke smelting. Inventing the process would not have paid.

What about the supply side?

In one of the final chapters, Allen reviews the supply-side arguments. He breaks these down into two hypotheses:

- Cultural: “British culture developed in a distinctive way that increased the propensity to invent and led to the Industrial Revolution.”

- Human capital accumulation: “Britain had more inventors because the population became more literate, numerate and skilled.”

Spoiler alert: he is going to be more sympathetic to the human capital argument.

An Industrial Enlightenment?

In The Enlightened Economy,

Mokyr … attributes the ongoing inventiveness of the Industrial Revolution to the Scientific Revolution and the Enlightenment. The connection was the Industrial Enlightenment, namely, ‘that part of the Enlightenment that believed that material progress and economic growth could be achieved through increasing human knowledge of natural phenomena and making this knowledge accessible to those who could make use of it in production’.

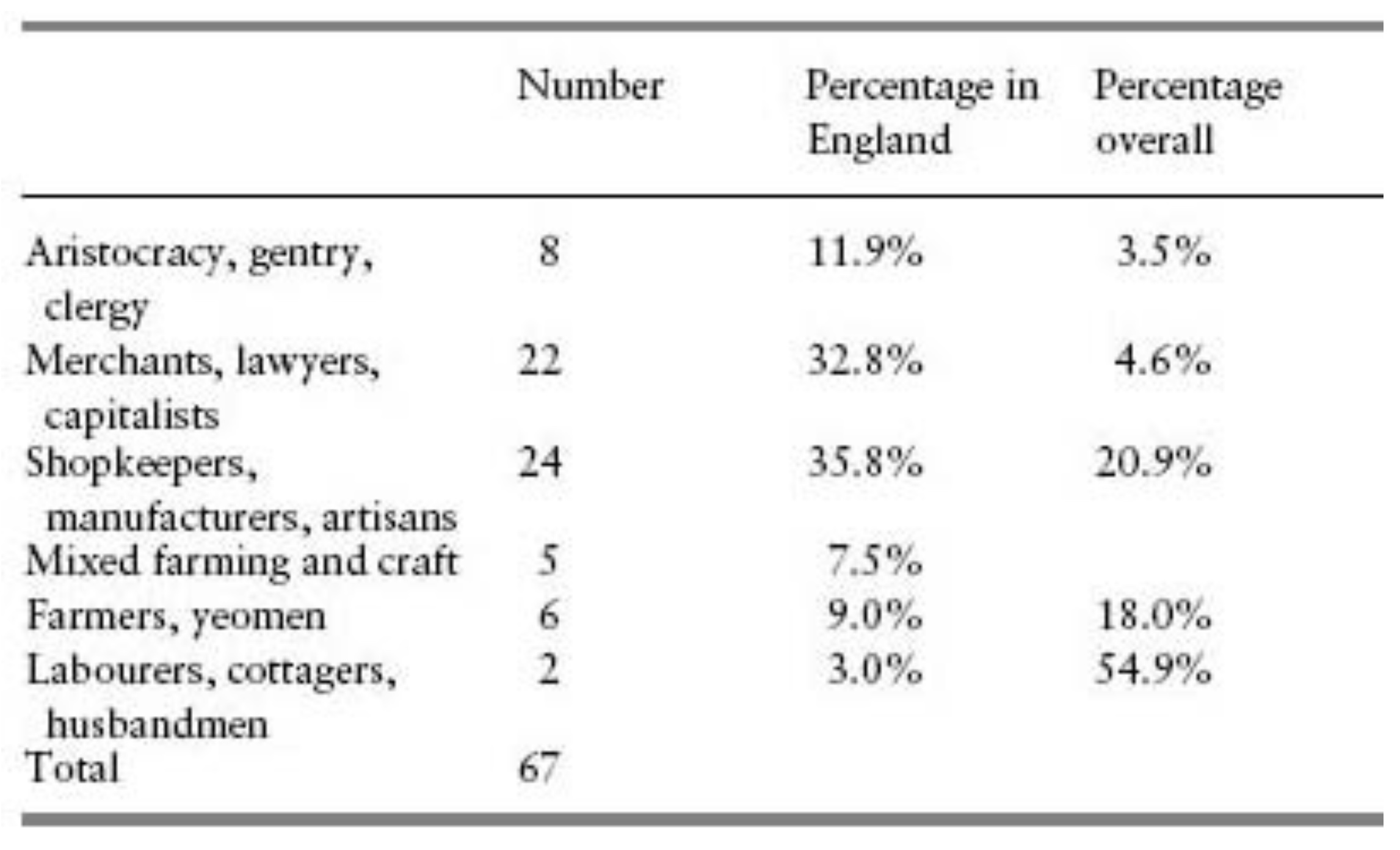

To test this hypothesis, Allen puts together a list of 79 important inventors of the 17th and 18th centuries, including all of the famous names such as Smeaton, Arkwright, Wedgwood, and Watt, as well as dozens of second- and third-tier inventors. He gives them three tests, corresponding to different dimensions of Mokyr’s theory:

Did they have “indications of involvement with Enlightenment science through either social intercourse, schooling or private instruction”? Here he finds a “mixed record.” Watt, Smeaton, and Wedgwood yes. Cartwright (inventor of the power loom), Newcomen, and Darby, not so much. Arkwright had such connections—but only after his success. In general, the links are strongest in the fields of horology, instruments, machines, navigation, and steam. Only about half the inventors in ceramics and chemicals have such links, and they are not prevalent among inventors in metals and textiles. Overall, it’s about half and half.

Were they experimenters? Yes, all of them: you can’t invent without experimenting. But experimenting is not new: it precedes even the Scientific Revolution; there have been tinkerers throughout history. The only thing new, Allen claims, is the quantity of experiments—and this can’t be explained by contact with Enlightenment science, which as we have just seen were inconsistent.

Could the Industrial Enlightenment have increased the level of experimentation indirectly, through general cultural changes? Many historians argue that Enlightenment led to the rise of secularism and a Newtonian mechanical worldview, and a decline in in the belief in magic and witchcraft. But Allen sort of shrugs and walks away from this hypothesis, saying that historians don’t agree about these shifts, and so “the case for a widespread adoption of the Newtonian worldview must remain conjectural. We must consider other explanations of the rise in experimentalism.”

Did they come from upper-class backgrounds? The Industrial Enlightenment, Mokyr says, was “a minority affair confined to a fairly thin sliver of highly trained and literate men.” Here Allen finds the strongest evidence. Inventors were “children of the commercial manufacturing economy,” in a literal sense: not only were they not working in agriculture, but neither were their fathers. He breaks down the inventor list according to the father’s occupation and finds that “the likelihood of someone’s becoming an inventor increased according to his father’s income and status.” For instance, “merchants, lawyers, and capitalists” made up only 4.6% of the population, but provided 32.8% of the inventors. Conversely, “laborers, cottagers, and husbandmen” made up 54.9% of the population, but only provided 3% of the inventors:

Human capital

The human capital hypothesis is that British inventiveness came from better education and training. Allen finds better support for this than for the “culture” hypothesis.

Most if not all of the inventors in the survey were literate and numerate. Most of them ran businesses, which requires writing letters and keeping accounts. And most of them were educated: privately, through schools, and/or through apprenticeships.

Further, there is good evidence that both literacy and numeracy were increasing in England in the 16th–18th centuries. In 1500, only an estimated 6% of English adults could sign their names; in 1800, that figure is 53%. And: “Landed gentlemen in 1500 could rarely add or subtract, while their successors two centuries later generally could.” One reason that more inventors came from upper and middle classes is that education expanded more rapidly in these groups.

So if education is needed for invention, and Britain was highly educated, that would explain why it was more inventive. But, Allen says, it’s hard to know how important education was, because high wages and cheap energy explain so much of the story. And there was not much difference between Britain and the rest of northwestern Europe in literacy or numeracy, so while these factors might explain why the Industrial Revolution was European rather than Asian, they can’t explain why it was British rather than Dutch. On the other hand, there were high wages in Europe for a time after the Black Death, and that didn’t lead to industrialization, so maybe human capital and even cultural factors can explain why the Industrial Revolution happened around 1800 rather than 1400.

Responses and criticism

The book has been much discussed since it was published in 2009. Mokyr’s The Enlightened Economy came out in the same year, and a paper by Nicholas Crafts, “Explaining the First Industrial Revolution: Two Views,” says that the views are not mutually exclusive and may be seen as complementary:

… a combination of Allen and Mokyr’s claims might produce the hypothesis that [technological development] resulted from the responsiveness of agents, which was augmented by the Enlightenment, to the wage and price configuration that underpinned the profitability of innovative effort in the eighteenth century.

After all, Mokyr is emphasizing supply factors, and Allen is emphasizing demand, but markets need both.

Other economic historians have pushed back on various elements of Allen’s argument:

Some claim that Britain’s wages were not as high as Allen says they were. For instance, Humphries and Schneider (2018) say that in yarn spinning, the work of women and children is frequently ignored, and that when it is accounted for, “spinning emerges as a widespread, low-productivity, low-wage employment, in which wages did not rise substantially in advance of the introduction of the jenny and water frame.” Stephenson (2017) says that estimates for building workers’ wages are too high, because fees were paid to contractors, and the actual wages paid to workers were 20–30% less. If British wages were not much higher than French, one leg supporting the argument becomes much weaker.

Others criticize Allen’s analysis. For instance, Gragnolati, Daniele, and Emanuele (2011) criticize his calculation of ROI of the spinning jenny. Those calculations assume that, using the increased productivity of the jenny, French workers would have worked less in order to produce the same output, rather than increasing output at all. This is implausible, and without this assumption, “the jenny turns out being profitable both in England and in France.”

Finally, others make more high-level arguments. Anton Howes points out:

… there is no mechanism by which the economic environment (the relative factor price structure) necessarily induces the inventive process. Imagine yourself a creative potter in the 18th Century—do high wages cause you to sit down and focus on a labour-saving invention? Or are you more likely to simply grumble and make do? There seem to be a few extra steps required here.

And the pseudonymous Pseudoerasmus adds:

… you already had capital-intensive production techniques in several sectors well before the classic industrial revolution period—especially in silk and calico-printing. Silk-throwing (analogous to spinning in cotton) was mechanised in Italy before 1700. The idea was pirated by Lombe who set up a water-powered silk-throwing factory circa 1719, and he was imitated by many others by the 1730s. Then you had heavily machine-dependent printing works for textiles (especially calicoes) in many European cities before the canonical industrial revolution period. None of these seemed to require Allen’s “high wage economy”.

Duncan Weldon has a brief, readable Twitter thread on the debate; Pseudo and Vincent Geloso have more in-depth summaries.

My conclusions

I learned a lot from this book; it is a classic in the field for good reason.

As is often the case, there are two ways you can interpret its thesis: a weak version and a strong version. The weak version is: “these demand factors are important, and they’ve been neglected or underrated.” That seems to be how Allen presents it in the introduction:

I do not ignore supply-side developments like the growth of scientific knowledge or the spread of scientific culture. However, I emphasize other factors increasing the supply of technology that have not received their due, in particular the high real wage.

That much I buy. Overall, I think Allen is pointing to a real phenomenon here, and his research and argument is solid.

The strong version is: “demand is the explanation for the Industrial Revolution, and supply is not really relevant.” Allen doesn’t say this, but it’s the impression I get based on the emphasis of the book. Also, in condensed statements like his popular article “Why was the Industrial Revolution British?” he drops all the nuance and deference to other arguments and just flatly says that the cause was economic. In any case, I don’t follow Allen all the way to the strong conclusion (if that is indeed his view).

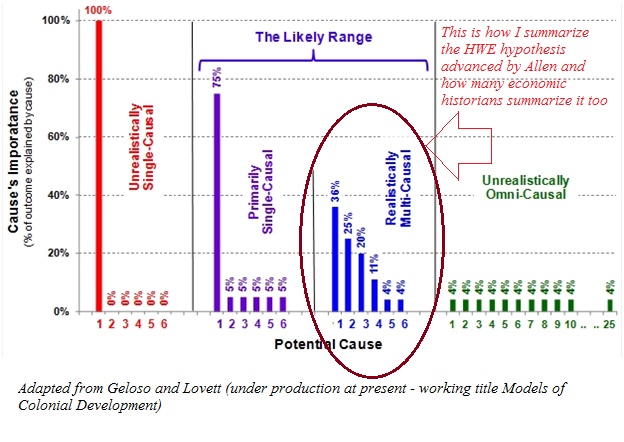

Vincent Geloso illustrates a spectrum of ways to think about this:

In the graph below, the “realistically multi-causal” explanation is how I see HWE [the High-Wage Economy hypothesis]. In Allen’s explanation, it holds the place that cause #1 does. According to other economists, HWE holds spot #2 or spot #3 and Mokyr’s explanations holds spot #1.

There is more to explain

One reason I don’t buy the strong claim is that Allen’s argument isn’t focused on the scope needed to make it. He is mostly seeking to explain mechanization and energy. But there are a lot more related phenomena going on at the same time (1700s–1800s):

- Improvements in factory organization, such as at the Wedgwood pottery works

- Improvements in agriculture, including new crop rotations and fertilizers

- Improvements in maritime navigation, such as the marine chronometer (which Allen mentions, and attributes to the Scientific Revolution)

- Synthetic chemicals, such as dyes and pharmaceuticals

- New materials, such as Portland cement and cellophane

- The development of immunization techniques against smallpox

- Improvements in sanitation, such as new sewer systems

- New social systems, replacing monarchy with representative government

- The abolitionist movement that ended slavery

- The beginnings of the women’s suffrage movement

(Anton and Pseudo make similar points in their posts linked above.)

I don’t see any fundamental factor price argument that can explain mechanization, energy, agriculture, navigation, materials, health, democracy, and equal rights. But the Enlightenment can.

We need to look earlier than the Industrial Revolution

That said, let’s take Allen’s conclusion for what it’s worth: mechanization and the use of steam power could only have taken off in an economy that already had high wages and cheap energy. Where did high wages and cheap energy come from?

High wages come from high productivity, so this points to pre-industrial productivity increases. Much of this came from improvements in agriculture (which Allen describes in chapters that I have omitted from my summary above, since they’re not on the core line of argument). Similarly, cheap energy came from developing Britain’s coal reserves. As Allen explains, this was not a matter of geology but of economics:

It is not simply a question of coal being in the ground, for Britain’s coal deposits were largely ignored at earlier dates and the exploitation of the coal resources of other countries—Germany and China are important examples—occurred centuries after the rise of the British coal industry. The exploitation of coal had social and economic causes.

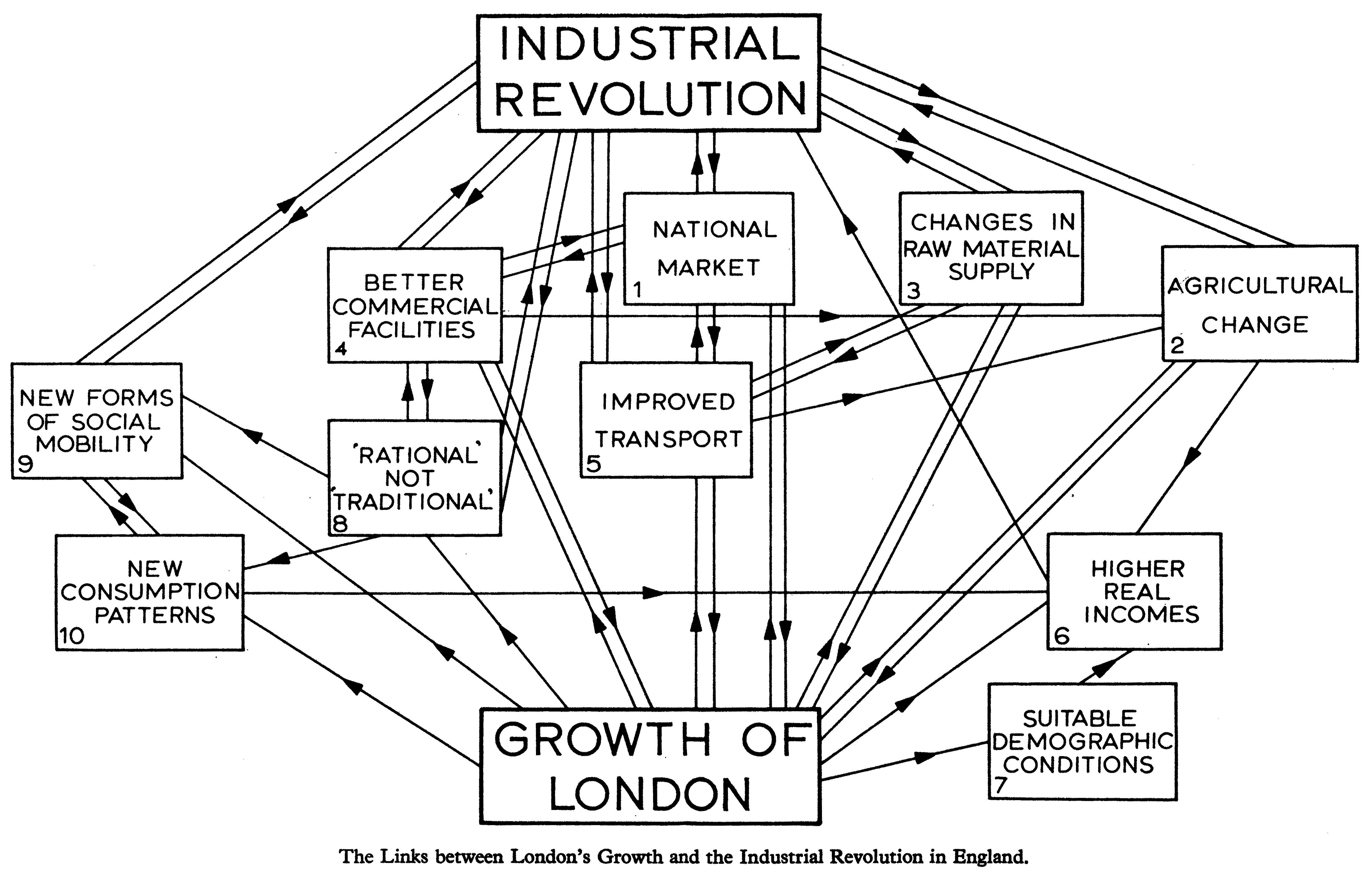

If we trace both of these things back further, Allen argues that they were driven by the growth of cities (especially London) and the expansion of trade. The growing cities pulled workers away from the farms, and created more demand for food, which motivated and necessitated improvements in agricultural productivity. New consumer goods from trade gave workers more to strive for and actually motivated them to work harder (the so-called “industrious revolution”). All of this expanding activity created more demand for fuel, and burned through all the wood, motivating and necessitating the development of coal mines.

In short, the pre-requisite of the Industrial Revolution was a certain amount of prior economic growth: wages and energy prices are a part of this, and those in turn are traced back to prior growth in cities and trade. Allen makes this point explicitly, multiple times. So to me, the key question is: where did that growth come from? And if we keep tracing it back, how far does it go? When did it all begin?

Allen’s goal is to explain the Industrial Revolution. In the sense that an economic historian uses that term, it is a narrow development: a period of less than a century from the late 1700s to the early 1800s that saw the diffusion of steam power and mechanization. But the Industrial Revolution is not an isolated phenomenon. It was the beginning of something much broader, the Industrial Age, which extends up to the present day and encompasses later developments such as mass manufacturing, electricity, internal combustion, synthetic chemistry, electronics, computing, and antibiotics. And that is part of a still broader phenomenon: the Great Divergence in which Western economies started growing faster than the rest of the world.

If what we want to understand is economic growth in the modern period, then we need to look earlier than the Industrial Revolution, simply because the story starts earlier. Agricultural improvements are evident by the 1600s. The rapid growth of London began in the 1500s. The voyages of discovery and the growth of printing had already differentiated Europe by the 1400s.

I think that Allen’s demand factors influence the shape or direction of progress, but I don’t see how they explain the rate of progress, which seems to me to be much more driven by supply factors. If you have a scientific society, surplus profits to invest in R&D, an educated, literate and numerate population, “bourgeois virtues,” a “culture of growth”—then progress is going to happen. Where the talent and investment go, what problems they work on, will be determined by what the biggest opportunities are at the margin, which depends on technical and economic factors in a given place and time. Maybe in the Middle Ages, the most important problems to work on were printing, trade routes, and agricultural productivity. By the 18th century, the top priority was industrialization.

In other words, industrialization was just one phase of a much bigger story that extends both before and after the Industrial Revolution. If you want to explain why that specific phase happened when it did, and why it happened in Britain rather than France or the Netherlands, then pointing to specific technical and economic factors such as wages and energy makes sense. But if you want to explain the bigger picture, the longer arc, I think you need to look to broader and deeper causes.

Thanks to Tyler Cowen, Pseudoerasmus, and the commenters here for feedback on a draft of this essay. The first draft was published here; this is the revised final draft published on The Roots of Progress.

One other factor, which I would class under demand factors: at each stage of the industrial revolution, you need to have enough demand for the primitive early version of your new technology, so that people will use it, iterate on it, and develop it.

You write "early Newcomen engines consumed ~45 pounds of coal per horsepower-hour; the most efficient engines of the late 1800s used less than one pound." But to get to those efficient engines, it had to be worth someone's while to use the very inefficient early Newcomen's engines, so that there was a version 1 which could be iterated into the 1lb/hp-hour version.

Bret Devereaux has an argument that this was specific to Britain, whose geology happens to contain lots of coal mines which were prone to flooding. (I recommend reading the whole thing.) So the very first use of a steam engine was to pump water out of coal mines. Because the use case was literally at the coal mine, there were zero transport costs for the coal (a major consideration in an era before railroads and steamships). The very inefficient Newcomen engines still raised more coal than they burned, which would otherwise have been inaccessible, so there was an economic use for them. The UK by this point had already cleared most of its forests, so there was demand for coal (not necessarily true in earlier periods). And the higher wages in England, which you discuss, meant it was cheaper to pump the water with steam engine than with muscle power even where muscle power was technically practical. His argument is effectively that without all of these factors, the very inefficient early steam engines would not have been economic, so no one would have iterated on them.

I don't think this is the only factor - you/Allen have gone through a lot of others, which also make sense. But I think it's worth considering that part of the answer to 'why did the Industrial Revolution start in England?' is geological accident.

Thanks! Yes, this is definitely part of Allen's argument (maybe I should make that more clear).

I've been meaning to read that Devereaux post/series for a while, thanks for reminding me of it.

However, I don't you think can argue from “the Industrial Revolution got started in this very specific way” to “that is the only way any kind of an IR could ever have gotten started.” If it hadn't been flooded coal mines in Britain, there would have been some other need for energy in some other application.

I see it more as: you develop mechanization and energy technology once you reach that frontier—once your economy hits the point where that is the best marginal investment in development. Britain was one of the most advanced economies, so it hit that frontier first.

Added a little bit in the revised version to try to clarify this. Thanks again for the feedback

Thanks Jason for the article, I think it's a useful lens for looking at the past.

The idea of having the right economic conditions for progress and invention reminded me of what Bill Gates calls the "Green Premiums" for the changes we need to make to move away from higher emissions (I imagine others have made the point before). Gates's argument is that we need to create the right environment to "prime" the world for investing and creating these more sustainable technologies, and it seems like a proactive way that one may try to recreate the an Industrial Revolution Britain. (Whether it would work or not is a different matter!)

The demand side of innovation has been highlighted many times in the past. As Liebenstein put it "The knowledge may have been there already and a change in circumstances induced the change in technique". More generally the Boserup hypothesis sets out how agricultural innovation is driven by increasing population densities. Adam Smith made the same point in his discussion of agriculture in the American colonies. That these ideas not widely known, or just forgotten, reflects how much more attractive people find the silver bullet, hero-inventor story of innovation. And how much more useful those ideas are for politicians.

I think what Allen probably added was a more quantitative investigation of this idea. He gathered the price data for fuel, labor, capital, etc. and did the analysis of rates of profit and return on investment.

Wages are both about productivity and about how much value workers capture of their work. I asked GPT4 for the factors of why London grew in the 16th century and one of the reasons it comes up with is:

Monks at monasteries were a class of people that were very poorly paid. GPT4 describes the economic effects further as: