Social media exploded with pent-up frustrations, swirling like an inexhaustible tornado, after the UnitedHealthcare tragedy. Why does health insurance produce such a wellspring of anger? In other markets, if you don’t like your meal, you send it back or pick a different restaurant. If your TV is faulty, you speak with customer service, or, if you do level up and tag the company on social media, there’s a good chance you’ll get an immediate, penitent resolution. Why does it seem like we’re screaming into the void with insurance?

1. Two’s company, three’s a complicated financial relationship

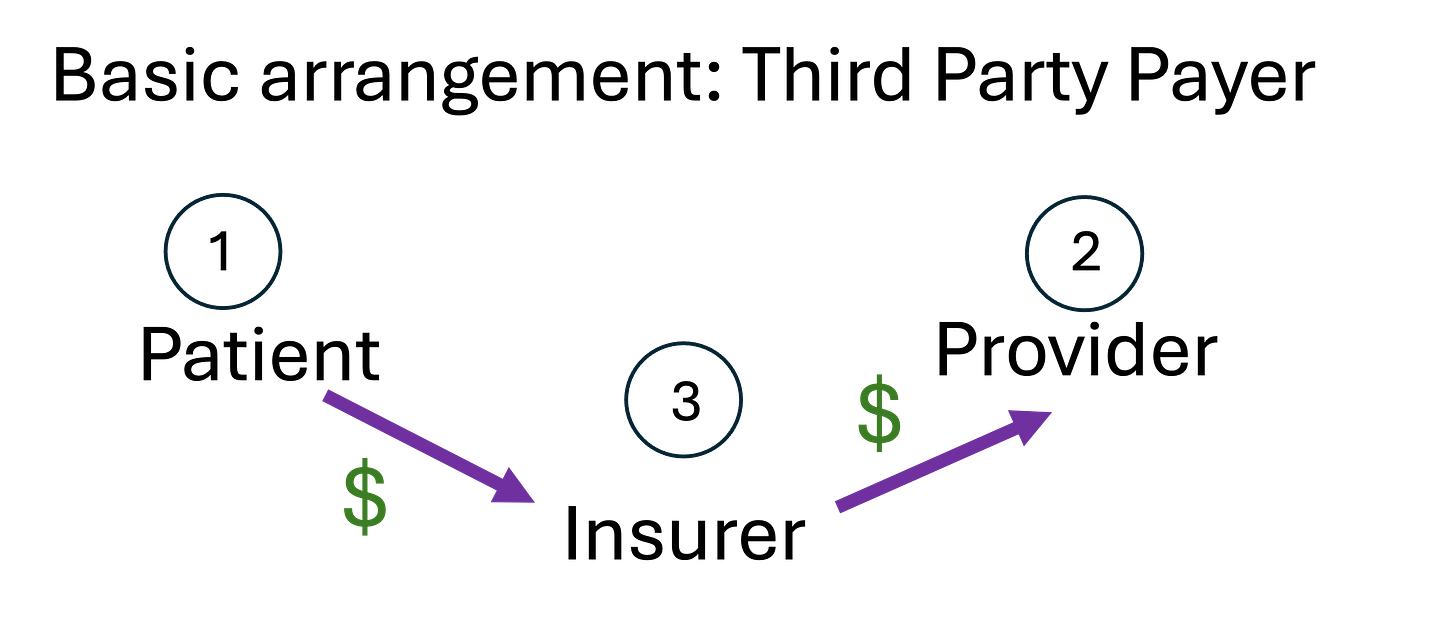

In the simplest version of an economic transaction, you, the consumer, buys an apple and pays the producer directly. A two-person party. Healthcare services are different from other parts of the economy because insurance is involved.1 My demand for apples is pretty predictable, but my need for cancer treatments is not. Insurance steps in to take care of the financial uncertainty in health care markets. However, this makes the party more crowded as the insurer acts as the financial go-between consumers (patients) and producers (providers). This is why an insurer is often called a “third-party payer”- they introduce a diversion in the payment stream.

Subscribe so you don't miss another stick figure explanation of complex health concepts!

2. Party Around the World

A key tool for attacking customer dissatisfaction in the rest of the economy, with the meal or the TV, is choice. Threatening to take your business elsewhere often prompts a speedier resolution of your problem. Where is choice in the insurance payment stream? It varies by how you construct your healthcare system.

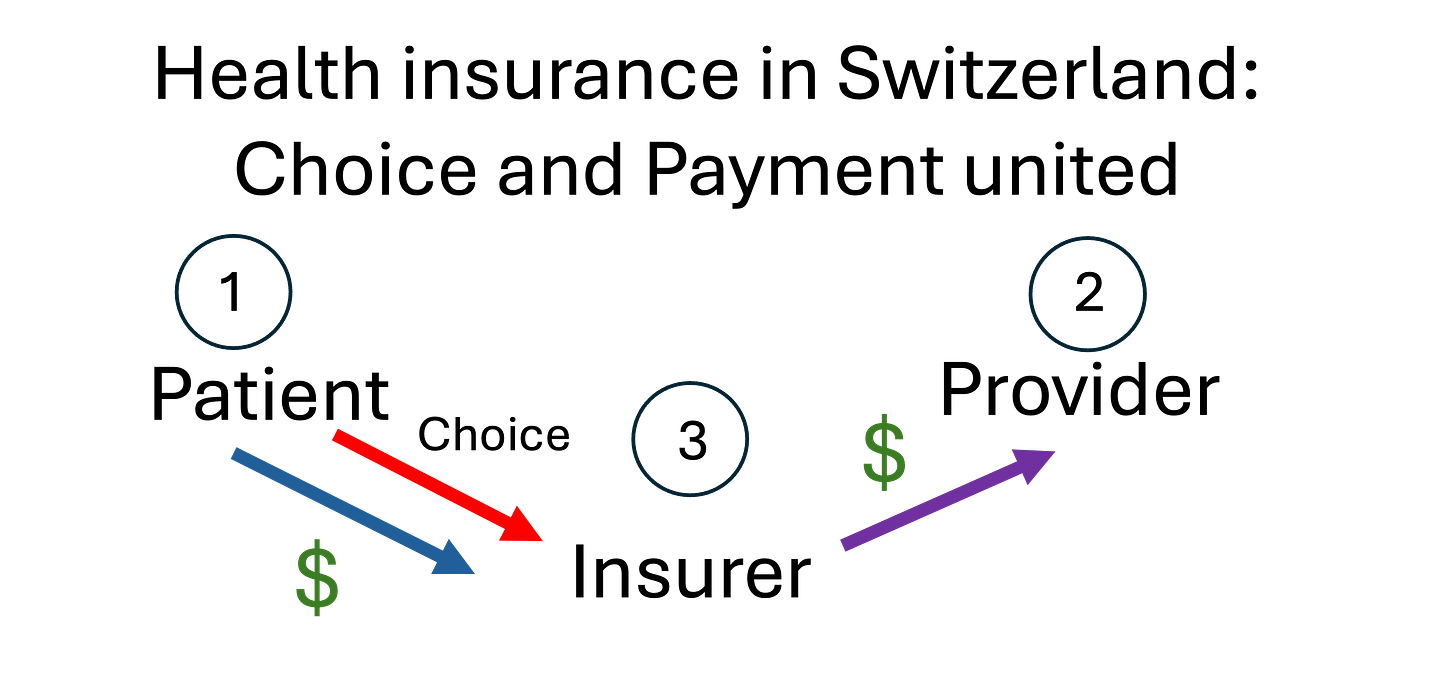

In the Swiss system, which was a model for our ACA Health Insurance Exchanges, patients purchase insurance directly from the insurer. There are three parties (patient, provider, insurer) and both choice and payment are united. The patient chooses the insurer they like best and is the sole payer to this insurer.

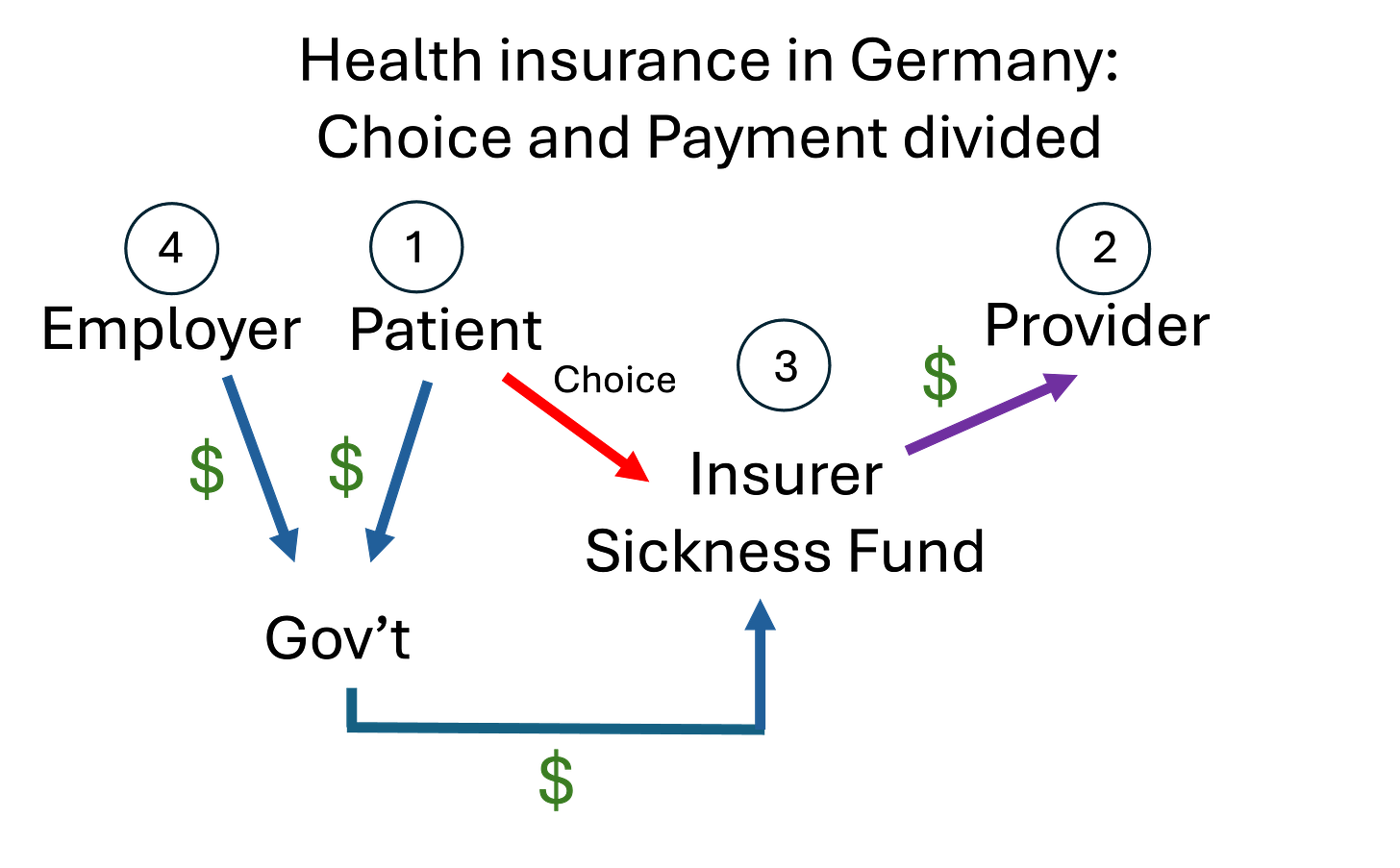

Germany introduces a 4th party into this picture: the employer. Germany mandates that health insurance financing must happen at the employer level. Employees/Patients can choose from approximately 110 “Sickness Funds” or nonprofit third-party payers. Payments from both the employee and the employer are pooled into a government fund which re-allocates the funding to individual Sickness Funds according to which saw the highest enrollment of sick patients.

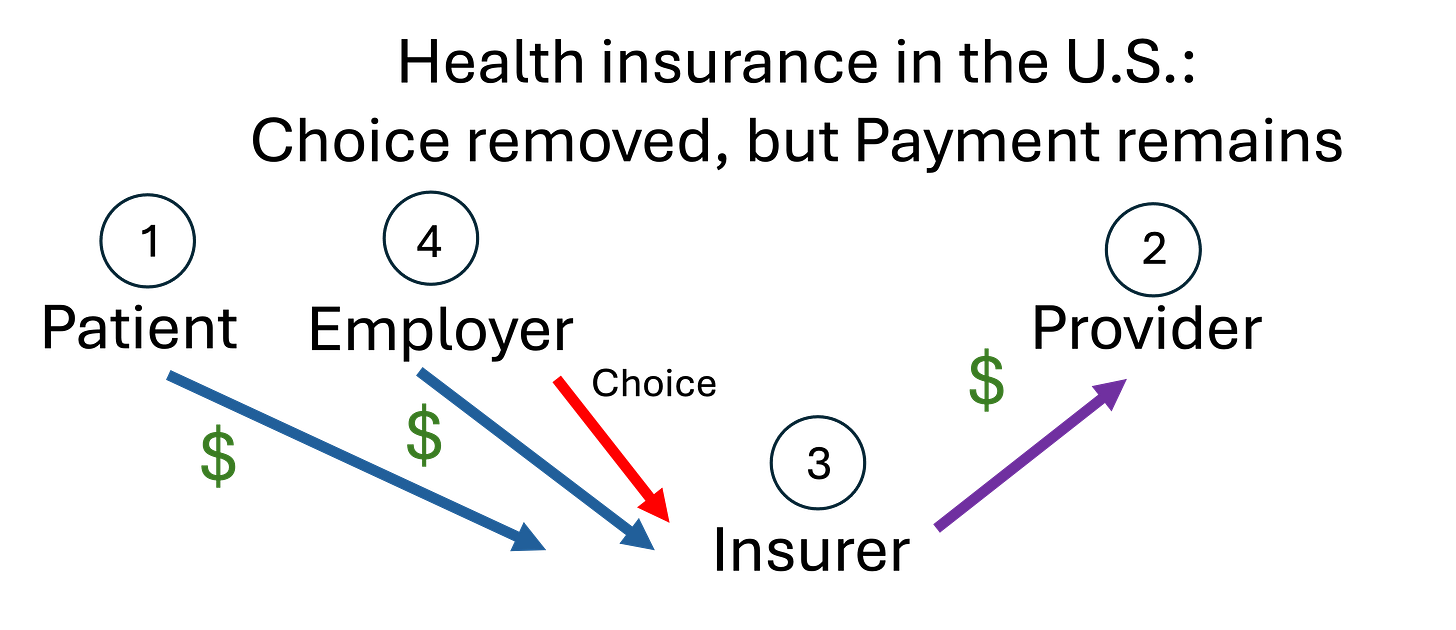

What does this look like in the U.S.? We also (largely) finance healthcare at the employer level, adding a fourth party.2 However, we have reversed the position of the patient and the employer. In our system, both the employee/patient and the employer make financial payments to insurance, but the choice of insurance is confined to the employer, not the patient. Maybe there’s a listening meeting about the upcoming plan change, but mostly it is a small committee in HR making the choice for everyone in the firm (and their dependents).

No wonder we feel powerless! Our only role in this diagram is to hand over money! It also explains why U.S. insurance companies have terrible patient service. Patient satisfaction has very little impact on their business. The insurance company’s main customer is not the patient, it is the employer.

3. Bring back the Party in the U.S.A.

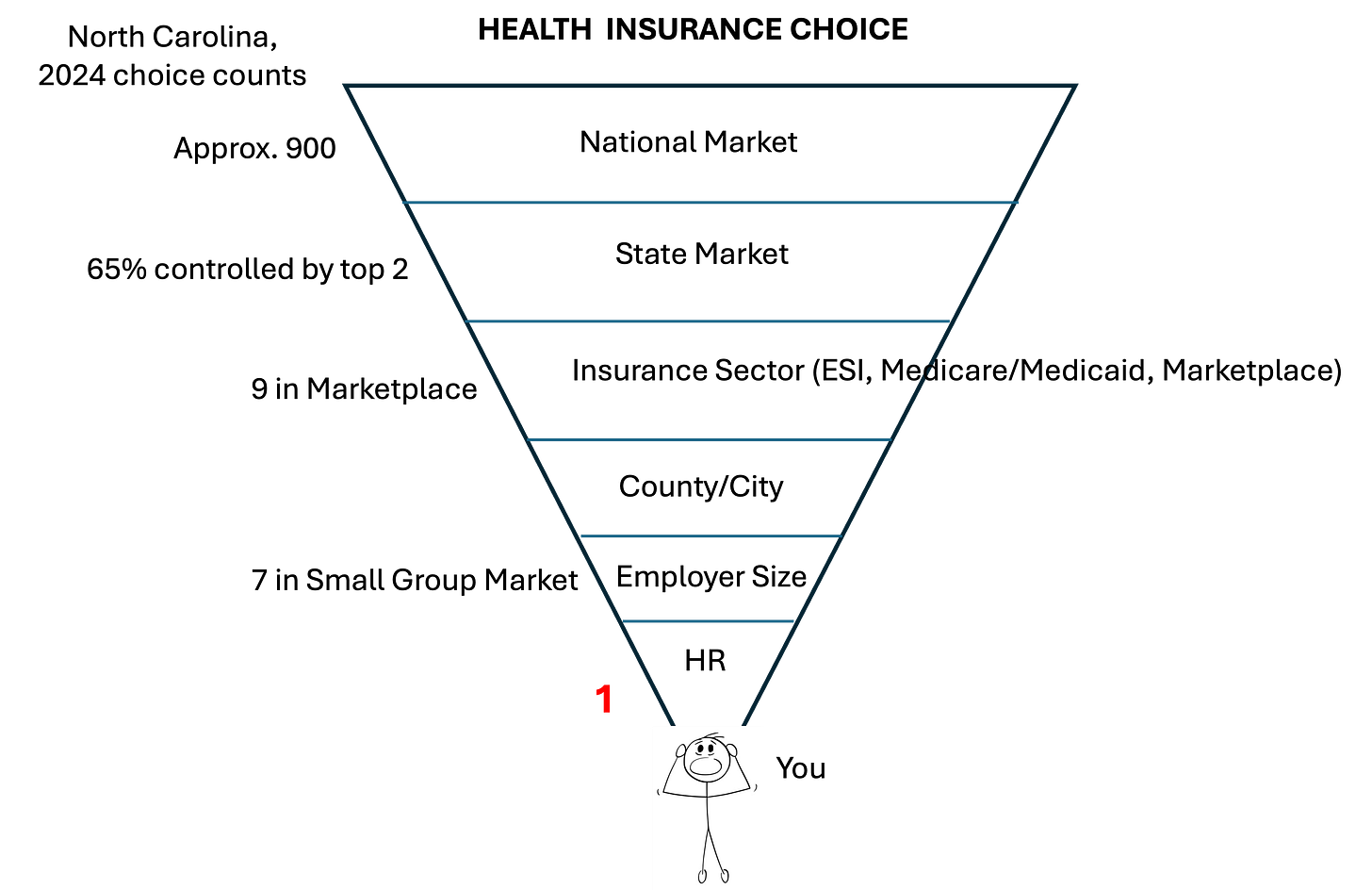

To review the earlier parts of this series, we saw that, although there are a multitude of insurance companies in the U.S., the set of insurers competing shrinks dramatically as we start defining markets. The national level shrinks to state because insurers can’t sell across state lines. The state market is segmented into sectors—Employer-Sponsored Insurance (ESI) is only one alongside the ACA Insurance Marketplace and Medicare/Medicaid. The ESI market further shrinks to regional markets since provider networks are local. Oh, and insurers’ offerings depend heavily on the size of the employer- larger firms are offered better coverage. Finally, your employer’s HR department chooses a plan for you, take it or leave it. You can see why a typical American feels crushed by the outcome of the health insurance process.

How could we improve this process? Make us all feel like partying again? Insurance companies like the current system, because it is lucrative maybe, but also because transferring choice from the patient to the employer removes their constant concern: adverse selection. Essentially, contracting exclusively with the employer means all the employees, both healthy and sick, will be on its plan. If contracts were at an individual level, maybe only the (expensive) sick would sign up while the (cheap) healthy opt out. But the U.S. is trying to fix this backwards! Instead of taking the choice piece away from employees/patients, we could fix the payment piece. Taking a page from Germany, a better system would open ESI employee choice to all local insurers, but pool employer and employee contributions into a locally centralized fund which allocates insurer payments based on the sickness case mix of employee choices. Patients would be back in the driver’s seat for choice, while insurers would be protected against unprofitable outcomes. Party on!

Best,

TMD

At least in industrialized countries, such as Europe, the US, and Japan. Of course, developing economies often have direct relationships with providers. Show up to a rural clinic, hand over cash to the provider, and get treated.

At least 178 million people, or 63 percent of working age adults. Kolb, Kristen et al. “Trends in Employer Health Insurance Costs, 2014–2023: Coverage Is More Expensive for Workers in Small Businesses” The Commonwealth Fund, Issue Briefs, Dec 10, 2024.