Explaining the method in the make-you-madness.

Prices in an insurance plan are like the snake-heads of Hydra, as soon as you understand one, three more seem to appear! Pay the physician office copay, and WHACK, out slither deductibles, coinsurance, and networks. It makes your head spin.

In Greek mythology, Hydra was placed in swamps of Lerna to haunt an entrance to the Underworld. Similarly, insurers birthed the complex pricing in modern plans to relentlessly guard their central goal: controlling costs. Controlling costs is key to insurers for two reasons. First, health care costs in the U.S. are high and continually rising, so insurers constantly battle to stem this rise for their own profitability and their patients’ premiums. But this continual rise is partly due to an inherent problem of insurance itself. Patients desire medical care to improve their health, but when they consume this care via insurance, they only pay a fraction of the cost. As a result, the type or amount of medical services you choose may not improve your health in proportion to how expensive the care is. A patient’s out-of-pocket payment and the true cost of the service are no longer linked. An insurer’s overarching fear is that patients will choose too many or inappropriate medical services, increasing the insurer’s bill but not improving your health very much. (This is called moral hazard, read more about it and how to pry "barnacles" off insurance here.)

The insurers’ Hydra price beast emerges from an omnipresent obsession to beat down costs. The staggering array of prices and rules in an insurance plan are all attempts to influence patient behavior by controlling who you see, where you go, and how much care you use.

Some insurance pricing components are effective both in influencing behavior and in keeping costs down. To make you think seriously about who you see, you pay a fixed fee, called a copay, every time you visit a provider. Generally, copays are designed to push you towards the least intensive care providers first. A primary care visit is $15, but a specialist, who charges higher rates and prescribes more expensive care, is $35. And, although the plan covers emergency care, they’ll slap a $200 copay on the Emergency Department to make you thoroughly consider this choice. Late on a Saturday with a cough? Perhaps I’ll just head to my urgent care with a copay of only $45.

Networks in insurance plans have also successfully controlled costs by influencing where patients go. Networks are lists of specific providers where the patient will pay a lower out-of-pocket cost. Done right, networks can gently nudge patients towards cheaper providers. Choosing a provider outside this list means patients pay higher percentages of their care, for example you’ll pay 10% of billed services at an in-network surgery center, but this jumps to 40% out of network. Why the preferential treatment of the network providers? Insurers threaten providers with networks to force to lower prices for their services. If providers agree to lower prices, they are placed “in-network” and enjoy a steady volume of patients. If they don’t, providers risk being left out in the cold, out of the network. The academic literature on HMOs, the fine folks who first brought us networks, consistently finds these plans have lower costs per patient and slower increases in costs over time.[1]

However, most patient frustration comes from the vicious, but ineffective, heads of the beast. These are the heads that attempt to influence how much you spend, relying on patients to “shop” for care. For example, having patients pay a percentage of the total bill of service, called coinsurance, or even pay 100 percent of the bill due to a deductible. In its most extreme form, High Deductible Health Plans (HDHP) have come into vogue in the past 10 years with the idea that forcing patients to cover the full cost of care would lead to better choices, more comparisons between alterative providers, and less unnecessary care. However, this approach is as chimerical as Hydra itself for two reasons. First, patients often don’t have the time or knowledge to make decisions about their care. If an out-of-network ambulance arrives at your door, will you send it away and wait for the next one? Even myself, a starry-eyed health economist, rushed my sweet toddler with a possible broken arm to what I thought was urgent care. When I discovered it was an ER instead, did I head home? Of course not!

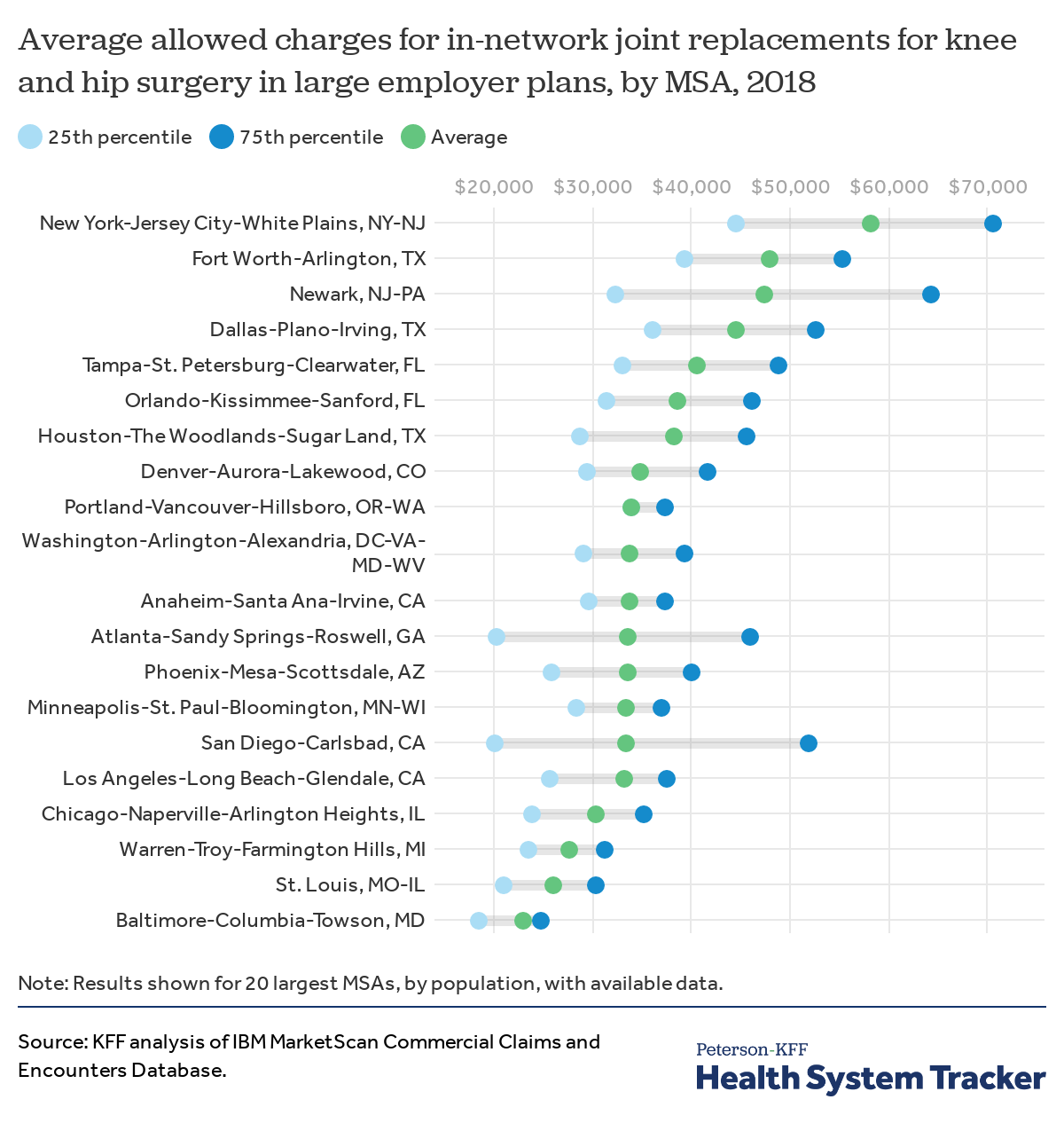

Secondly, prices are simply mythical on the consumer side of health. The final price of care you consume is a combination of the provider you chose, the way the services were coded and billed, your particular insurance company, and the particular plan you have within the insurer’s plan offerings. That’s a four-dimensional reality! Prices are negotiated over each of these dimensions in private contracts that are not publicly listed information. Even recent legislation to legally require hospitals to list prices is a bit naïve. Just as savvy shoppers know the stores you should never shop at without that 25% off coupon, publicly listed prices will always vary widely from deals struck behind closed doors through private contracts.

In mythology, Hercules was ultimately able to defeat Hydra by finding and slashing the one immortal head among the many. What could defeat the immortal head of this insurance madness for good? My next commission to Hercules, or maybe you, a Hydra-crushing hero, is to go forth and release prices from their secret cells! More price transparency in health care markets would give consumers meaningful choice, less frustration, and maybe even remove the need for the Hydra pricing beast in the first place.

[1] A nice study to understand the forces at play in HMOs is Ho, Pakes, Shephard, (2018), examining approximately 78% of the Massachusetts insurance market. They found that HMO per-patient costs were actually declining during their period of study, even after accounting for increases in age and sickness over the period. Ho, K., Pakes, A. & Shepard, M. The Evolution of Health Insurer Costs in Massachusetts, 2010–2012. Rev Ind Organ 53, 117–137 (2018).

Digging into specific treatments, Sacks (2018) finds that HMOs spend 20% less on statins through the channels of patient choice and physician incentives. Daniel W. Sacks, Why do HMOs spend less? Patient selection, physician price sensitivity, and prices, Journal of Public Economics, Volume 168, 2018. Pages 146-161.

.

Hi Annie, thanks for your detailed response. Please be a bit more respectful. You can make your counterarguments without using terms like “absurdly weak” or “nonsensical”. Thank you.

I think that this is broadly correct. One of the biggest problems of health care in America is that the feedback mechanisms that control cost (such as honest and public prices) are completely broken, and fixing them would likely go a large way towards solving the problem.